In the financial world, especially the stock market, day trading stocks has become a familiar term to those passionate about trading and seeking opportunities for quick profits. With its flexibility, ability to capitalize on intraday price fluctuations, and lack of overnight risk, day trading stocks method attracts millions of investors worldwide. So, what is day trading stocks? Let’s explore together with Tipstrade.org in this article below!

What is day trading stocks?

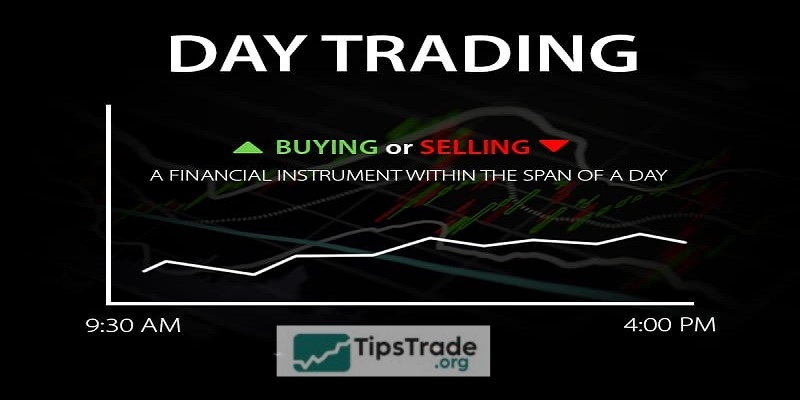

Day trading stocks is a short-term trading strategy where investors buy and sell stocks within the same trading day, meaning all positions are closed before the market closes. The goal is to profit from small price movements that occur throughout the day, rather than holding stocks for long-term growth.

>>See more:

- Long-Term Stock Investing: Benefits and Key Principles to Understand

- How To Buy Stocks in 4 Steps: Quick-Start Guide for Beginners

- ETF Investing: The Ultimate Guide for Beginners

Day trading stocks vs. long-term stock investing

Day trading and long-term investing are two contrasting strategies for making money in the stock market, each with its own goals, risks, and time horizons.

|

Feature |

Day trading stocks | |

|

Time Horizon |

Intraday (seconds–hours) |

Months–years |

|

Primary Focus |

Technical patterns, volatility |

Business fundamentals, growth |

|

Typical Profit Target |

Small daily gains, often 1–5% |

Large compounding returns |

|

Leverage |

Commonly used |

Rarely used |

|

Activity Level |

Very high, full-time mindset |

Low to moderate |

|

Risk Level |

High (rapid capital loss possible) |

Moderate to high (market risk) |

|

Skill Required |

Speed, charts, swift execution |

Research, financial analysis |

|

Costs (commissions etc.) |

High turnover costs |

Lower if long-term |

|

Emotional Pressure |

High; can be stressful |

Lower; more patience-based |

|

Typical trader/investor |

Intraday speculators, prop traders |

Buy-and-hold investors, retirees, wealth builders |

Benefits and risks of day trading stocks

Before choosing day trading stocks strategy, traders need to understand both the benefits and risks involved. Below are the prominent benefits and risks of this trading method:

Benefits of day trading stocks

- Minimize long-term risks: Day trading stocks will be a trading session that ends at the end of the day, so traders will not have to worry about fluctuations that may occur during the night. Therefore, it also minimizes the risks of losing money in a short time.

- Faster return on investment: In case your day trades are profitable, this also means that you can take the profits from the previous trading day to create a bigger advantage on the next trading day.

- No overnight fees: Day Traders do not hold positions overnight so there is no need to calculate overnight fees.

- Improve practical skills: As you know, day trading stocks is a day trading method so traders will not have much time to think, from which quick analysis skills and practical experience will be significantly improved.

>>See more:

- Technical Analysis for Stocks: The Complete Guide for Modern Investors

- How To Read A Stock Chart: Exploring Key Types & Pro Tips

- What is Stock Liquidity? Why It’s Important for Investors

- What is Stock Market Index? Top 8 Stock Market Index You Should Know About

Risks of day trading stocks

- Capital issues: Basically, day trading stocks is a way to make profits in the short term, you will make small profits from many orders together. Therefore, to be able to get a large profit by “accumulating small things into big things”, you also need to prepare yourself a decent amount of capital.

- High risk for newbies: For newbies who do not have much experience and knowledge, they will encounter many financial losses during the first trading period.

- Stress: Obviously, when traders have to make quick investment decisions in a short period of time, they will easily fall into a state of stress and pressure. Invisibly, this is one of the reasons that leads to unwise decisions.

- Cannot participate in the entire trend: Since you will be closing your trades during the day, you will not be able to hold your position for the entire trend. This significantly reduces your chances of making a larger profit.

Strategies for day trading stocks

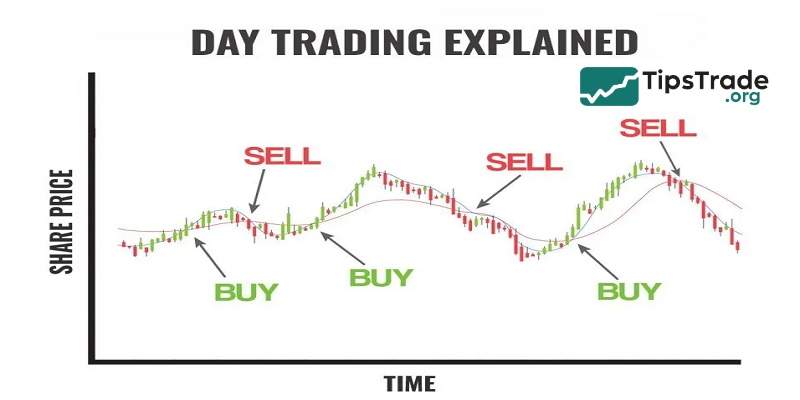

There are many strategies that day trading stocks traders can use to take advantage of short-term price movements, such as:

- Range trading: Using identified support and resistance levels as entry and exit points, to take advantage of small price fluctuations.

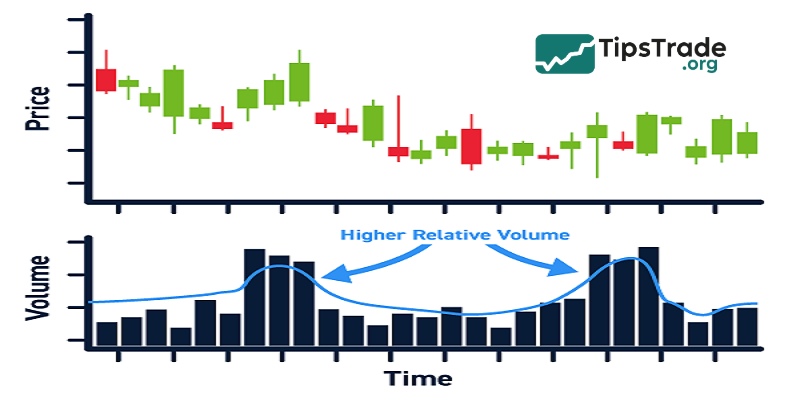

- Volume trading: This strategy focuses on finding stocks that are experiencing a spike in trading volume, then opening a position and holding it until the volume drops.

- High-frequency trading: Using computer programs to place large orders in short periods of time, to exploit market irregularities.

- News trading: Based on strong price movements that occur around political, economic or corporate events of the day.

Strategies for day trading stocks can be applied to many different asset classes, not just stocks.

How to choose stocks for day trading

To choose the right stocks for day trading, it is important to have the right tools built into your trading platform. For most traders, a stock scanner is an essential tool to help them find the “hot” or volatile stocks in the market.

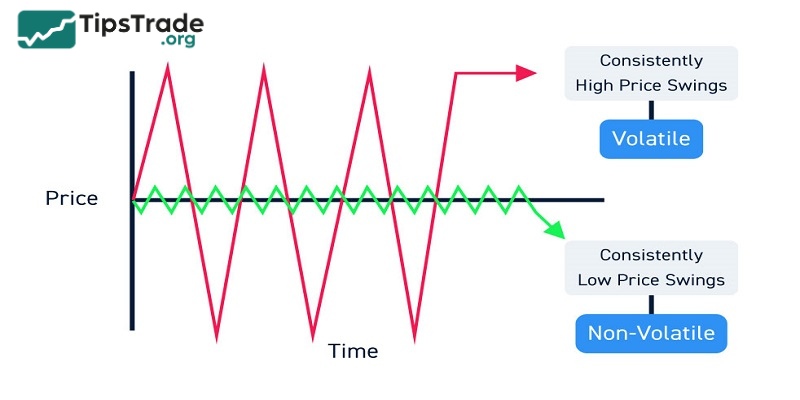

The best stocks to day trade are typically those with both high volatility and high volume.

- Volatility: This is the percentage change in a market over a given period of time. It shows how quickly prices move, but does not indicate a specific direction. This indicator is often displayed as %Change in platforms or as beta, a measure of a stock’s volatility relative to the overall market.

Typically, a beta of 1.0 is assigned to a benchmark. If a stock’s beta is greater than 1.0, it is more volatile than the market; conversely, if its beta is less than 1.0, it is less volatile.

- Volume: This is the number of buyers and sellers active in the market at that moment. The higher the volume, the easier it is to open and close positions quickly. Volume is a lagging indicator, usually updated every 5 minutes, and can be found on stock exchange websites.

Best day trading stocks

The best stocks for day trading are those with high average daily trading volume, good liquidity, and high volatility in the stock market. Below are some of the most popularly traded stocks each day that investors can refer to:

|

Rank |

Stock | Daily trade volume (Nasdaq) |

Beta (5Y Monthly) |

|

1 |

Tesla Motors | 169,139,561 |

2.18 |

|

2 |

Nvidia Corp | 50,631,196 |

1.65 |

|

3 |

Meta Platforms | 33,252,404 |

1.33 |

|

4 |

Microsoft Corp | 31,526,278 |

0.93 |

|

5 |

Apple Inc | 65,706,406 |

1.23 |

|

6 |

Amazon.com | 63,704,626 |

1.33 |

|

7 |

Alphabet Inc A | 41,111,372 |

1.08 |

|

8 |

AMC Entertainment | 6,731,325 |

1.67 |

|

9 |

Alibaba Group Holding | 14,981,030 |

0.58 |

|

10 |

Netflix | 6,419,400 |

1.36 |

Is day trading stocks right for you?

As one type of trading with its own characteristics, not everyone is suitable to start with the day trading stocks method. So who is suitable for day trading stocks?

- People with sufficient experience and knowledge: Day trading stocks is a short-term trading strategy, with little time for thinking and placing orders. Therefore, traders need to gather solid experience and knowledge to manage capital and risk most effectively. Avoid betting everything on luck.

- Have a lot of free time during the day: Since this is a short-term profit strategy, traders don’t have much time to analyze or evaluate the market. Hence, dedicating a significant amount of time each day is essential for success.

- Those with a “steel” mindset: Because trading periods are short and prices fluctuate rapidly, traders need a strong mental state and high self-discipline. Without these, it’s easy to panic, close positions prematurely, or make poor trading decisions.

- Those who prefer “quick trades, quick profits”: Certainly, a short-term investment strategy like day trading stocks will be the right method for those who prefer flexibility and want quick profits.

How much money do you need to day trade stocks?

There is no fixed amount of capital required to day trading stocks. Because, most brokers today do not set a minimum deposit. However, if you plan to trade on margin, you will have to maintain a minimum margin requirement in your account to keep your positions open.

If the available funds in your account fall below the minimum margin level, you will receive a margin call. If you do not add more funds, your open positions may be closed automatically.

When trading with leverage, the most important thing is that you should never risk more money than you can afford to lose.

Conclusion

In fact, Day trading stocks is considered an extremely attractive investment strategy because it has low risk and yields quick profits. That being said, this investment method won’t be suitable for everyone, as the unique nature of day trading stocks is not easy to grasp. Hopefully, this article from Tipstrade.org will help you better understand what day trading stocks is and provide you with useful knowledge about it.