Long-term stock investing is a popular choice among investors due to its stable returns and lower risk. If you’re still unsure about what long-term stock investing is, its benefits, and the key principles to follow, this article is for you. Let’s explore long-term stock investing together with Tipstrade.org.

What is long-term stock investing?

Long-term stock investing is the strategy of buying and holding stocks, bonds or investment funds for a long period of time, usually at least 1 year or more. The main objective of long-term stock investing is to take advantage of the sustainable growth of the business to increase the value of assets.

Characteristics of long-term stock investing:

- Focus on the real value of the business.

- Less affected by short-term market fluctuations.

- Suitable for investors with long-term vision and tolerance for temporary risks.

>>See more:

- Technical Analysis for Stocks: The Complete Guide for Modern Investors

- How To Read A Stock Chart: Exploring Key Types & Pro Tips

- What is Stock Liquidity? Why It’s Important for Investors

- What is Stock Market Index? Top 8 Stock Market Index You Should Know About

Benefits and risks of long-term stock investing

With any form of investment there are benefits and risks, the same goes for long-term stock investing. There are some benefits and risks to consider.

Benefits of long-term stock investing

Long-term stock investing brings the following benefits:

- High security: Long-term investors tend to focus on buying stocks of reputable companies. These stocks rarely lose value over long periods of time.

- Good and stable profit: The returns earned from growth stocks will typically be higher than those from savings.

- Little or no impact on market fluctuations: Long-term investors will be less concerned with small and short-term fluctuations in stock prices.

- Save time: Extremely suitable for busy investors who do not have much time to monitor the market continuously.

Risks of long-term stock investing

Long-term stock investing also face some risks:

- The most obvious drawback is that it takes a long time to make a profit, which requires patience and careful calculation from the beginning.

- Stocks can grow strongly in a short period of time, but the average long-term returns are often not as high as other investment areas such as real estate or investing in new businesses. Therefore, investors need to invest in many different companies to maximize profits and minimize risks.

- Long-term stock investing requires investors to assess the financial health and prospects of a company. This requires a deep understanding of the industry and the company’s business, as well as relevant economic and political factors.

Long-term stock investing vs. short-term stock investing

Stock investment can be divided into two main forms: short-term and long-term stock investment. Each form has characteristics and properties suitable for different investor groups. Understanding the difference between these two forms helps investors choose the method that aligns with their financial goals and risk appetite.

| Criteria | Short-Term Stock Investing | Long-Term Stock Investing |

| Duration | Less than 1 year, usually from a few days to several months. | More than 1 year, typically 3 years or longer. |

| Profit Objective | Earning profits from short-term stock price fluctuations. | Achieving sustainable and stable asset growth over time. |

| Risk Level | High, due to strong and unpredictable short-term price volatility. | Lower, as it is less affected by short-term market fluctuations. |

| Main Influencing Factors | News, short-term events, and daily or weekly market movements. | Macroeconomic trends, long-term growth potential of companies, industries, and the economy. |

| Investment Strategy | Swing trading, trend following, or trading based on market news. | Selecting companies with strong financial foundations and stable growth potential. |

| Liquidity | High — easy to buy and sell quickly when needed. | Lower, since stocks are held for a longer period. |

| Management Level | Requires constant market monitoring and quick portfolio adjustments. | Does not require frequent monitoring — focus is on long-term strategy. |

| Expected Return | Fast but unstable, depending on short-term fluctuations. | Stable and sustainable, benefiting from compound returns over time. |

>>See more:

- ETF Investing: The Ultimate Guide for Beginners

- What Is Stock Valuation? Notes When Valuation Of Stocks

- Understanding Dividend stocks and how to invest in them

- What Is a Stock Broker? Essential Skills and Average Salary of Being a Stock Broker

The principles of long-term stock investing for beginners

Choose to invest in reputable companies

To invest in stocks effectively over the long term and minimize risks, investors need to follow some important principles. First, choosing stocks of reputable companies with a stable operating history and sustainable growth potential is a key factor. Carefully studying the financial statements, business models and competitive positions of the enterprise helps to identify reliable stocks.

Determine the right time to buy stocks

You should carefully evaluate multiple factors to determine the most suitable time to buy, ideally when the stock price is below its intrinsic value. This approach allows you to maximize potential profits.

Diversifying your investment portfolio

Next, portfolio diversification is an important strategy to reduce risk. Don’t put all your eggs in one basket; instead, spread your investments across a variety of stocks across different industries. This helps balance returns and minimize the negative impact of one industry’s downturn.

Maintaining a strong mindset and discipline in investing

In addition, patience and discipline in long-term stock investing are indispensable factors. The stock market is always volatile, but maintaining an investment strategy and not being affected by short-term fluctuations will help investors achieve long-term financial goals. At the same time, regularly update economic, political information and market trends to make timely adjustments in the investment portfolio.

Managing risks and investment capital effectively

You should determine your investment capital based on your personal financial capacity and avoid using funds meant for daily living expenses. This approach helps reduce financial pressure when the market experiences volatility.

Long-term stock investing strategies

Long-term stock investing requires a detailed plan, patience and good analytical skills to achieve sustainable profits. Below are the basic steps to help investors build an effective strategy:

- Step 1: Determine your financial goals and risk appetite

- Step 2: Research the market and potential stocks.

- Step 3: Build a diversified portfolio.

- Step 4: Place a buy order when the trading price is reasonable.

- Step 5: Evaluate the company’s financial statements.

- Step 6: Monitor and manage your portfolio.

- Step 7: Maintain a steady investment mentality and be patient.

Some strategies commonly used in long-term stock investing that bring high efficiency include:

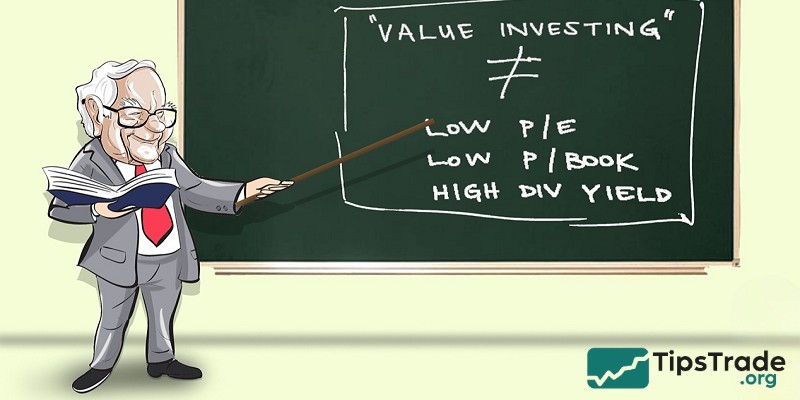

Value investing

This strategy focuses on finding stocks that are undervalued. During a market recovery from a recession, valuation based on net asset value (NAV) is a reasonable choice. During a strong economic growth, valuation methods based on comparing relative multiples (P/E, EV/EBIT) or discounted cash flow (DCF) will be more effective.

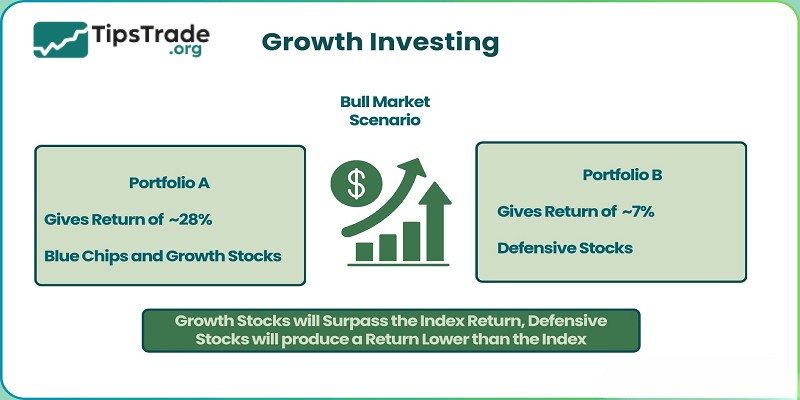

Growth investing

Investors focus on businesses in the technology, biology, and fintech sectors that have great potential for growth. However, caution is needed to avoid risks because businesses can be overvalued due to the influence of crowd psychology. Therefore, investors need to carefully analyze and control risks when investing according to crowd psychology.

Dividend investing

Many investors do not appreciate this strategy in the short term because the dividends are not attractive enough compared to focusing on the profit from the difference between buying and selling. But in the long term, a good stock will have a relatively attractive dividend, which can even be higher than the interest rate of bank deposits.

Best stocks for long-term investment

Tesla (TSLA)

- Corporate Group:Tesla

- Industry:Electric cars

Tesla is a globally renowned electric car company. It was founded by Elon Musk in 2003 with the aim of creating clean, energy-efficient and emission-free cars. Tesla has pioneered the development of electric car technology and has become one of the leading manufacturers in the electric car industry.

Google (GOOG)

- Corporate Group:Google

- Industry: Technology

Google is an American multinational technology company that specializes in Internet-related services and products. Google was founded in 1998 by Larry Page and Sergey Brin while they were students at Stanford University. Google’s main website is the world’s leading search engine, allowing users to search for information on the Internet. In addition, Google provides services such as Gmail, Google Maps, YouTube, Google Drive, and many others.

Apple (AAPL)

- Corporate Group: Apple

- Industry:Electronic technology

Apple is a leading technology company in the world, known for its innovative electronic products and technology services. Founded in 1976 by Steve Jobs, Steve Wozniak and Ronald Wayne. Apple has become a symbol of creativity and innovation.

Amazon (AMZN)

- Corporate Group: Amazon

- Industry:Internet Retail

Amazon (AMZN) is an American multinational e-commerce and cloud services company. It was founded by Jeff Bezos in 1994 and initially started as an online bookstore. However, Amazon quickly expanded and became one of the leading technology companies in the world.

Microsoft (MSFT)

- Corporate Group:Microsoft

- Industry:Software

Microsoft (MSFT) is a leading global technology company that produces and develops software, electronic products and related services. The company was founded in 1975 by Bill Gates and Paul Allen, and has since become one of the largest and most successful technology companies in the world.

Conclusion

Long-term stock investing is considered a safe and effective way to make money. Apply the principles as well as strategies mentioned above carefully to ensure a smooth and successful investment journey. And don’t forget to keep updating your knowledge and staying informed about the market to choose the right time to invest!