Prop Firm Process is a structured evaluation pathway that traders must complete to qualify for trading with a proprietary trading firm’s capital. This process allows traders to demonstrate their trading skills, risk management, and consistency without risking their own funds. By passing a series of challenges and verification steps, traders earn access to a funded account where they can trade live capital and share profits with the firm. Understanding this process is essential for anyone aiming to turn trading skills into a reliable income through institutional-level funding. The article above from Tipstrade.org has just provided you . We hope that you find it useful. Wishing you successful trading!

What Is the Prop Firm Process?

The prop firm process is a structured pathway traders must navigate to qualify for trading with a proprietary firm’s capital. It generally involves a two-step evaluation: an initial evaluation (often called a “challenge”) and a verification phase.

Key Steps in the Prop Firm Process

-

Initial Evaluation (Challenge): Traders are given a simulated trading account with virtual capital. They trade under real market conditions while adhering to strict rules such as profit targets, maximum drawdown limits, daily loss limits, and minimum trading days.

-

This phase assesses the trader’s skills, discipline, risk management, and consistency.

-

Verification Phase: After passing the initial challenge, traders move to a verification stage where they trade again, sometimes with tighter rules, to confirm consistent performance and risk adherence.

-

Funded Account Access: Upon successful completion of these stages, traders gain access to a funded live account provided by the firm. They can trade with the firm’s capital and share profits, often retaining 70-90% of earnings.

-

Ongoing Monitoring: Traders must continue to follow risk management rules while trading funded capital to maintain their account status.

Purpose and Benefits

-

The process ensures only skilled, disciplined, and consistent traders manage institutional funds.

-

Traders avoid risking personal capital while potentially earning sizeable profit shares.

-

Prop firms protect their capital by enforcing strict evaluation and trading rules.

Similarities Among Firms

Most proprietary trading firms such as FTMO, The Funded Trader, and Fidelcrest employ similar evaluation frameworks focused on discipline, consistency, profitability, and risk management adherence.

Typical Evaluation Metrics Include

-

Profit target to reach within the challenge period

-

Maximum trailing drawdown (largest drop allowed from peak equity)

-

Daily loss limits to avoid catastrophic drawdowns

-

Minimum number of trading days to prove consistency

>>Read more:

- What Is Prop Firm? Everything From A – Z Traders Need To Know

- Unpacking How Prop Firm Works For Professional Traders

- Prop Firm Benefits – Why More Traders Join Funded Programs

- Prop Firm Rules: The Complete Guide to Succeeding in Proprietary Trading

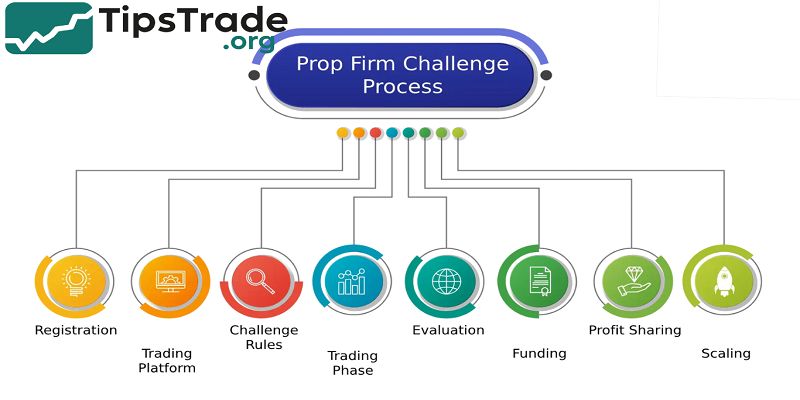

Step-by-Step Overview of a Typical Prop Firm Process

Step 1 – Registration & Account Setup

- The process begins when traders register with a prop trading firm and choose their preferred account type—usually varying by balance size, leverage, and profit targets. After payment, the trader gains access to a demo evaluation account.

- During setup, traders receive the firm’s rules and objectives, including profit targets (e.g., 8–10%), maximum drawdown limits, and daily loss caps.

- It’s crucial to review these carefully since even minor violations can lead to disqualification.

- Experienced traders recommend creating a trading plan and logging trades to maintain discipline throughout the challenge.

Step 2 – Evaluation Phase (Challenge Stage)

- In this phase, traders must prove their consistency and risk control within a limited period—typically 30 days. Most prop firms set a profit target (e.g., 8%) while requiring traders to avoid breaching the maximum daily loss or overall drawdown rules.

- This stage evaluates technical skill, emotional discipline, and adherence to firm guidelines. Passing the challenge isn’t about taking high-risk trades but maintaining stable performance. Many successful traders emphasize treating the challenge like a live account to build sustainable habits.

Step 3 – Verification Phase (Consistency Test)

- After passing the first phase, traders enter a verification phase (also called the “Stage 2 challenge”).

- Here, profit targets are lower (around 5%), and firms mainly test risk management and consistency.

- This step confirms that traders can replicate their performance under similar market conditions without emotional overtrading.

- Consistent trade size, proper stop-loss usage, and risk-reward balance are key. Data from top prop firms show that only 15–20% of traders reach this stage, highlighting the discipline required.

Step 4 – Funding Approval & Live Account Access

- Once verified, traders receive their funded trading account. This marks the start of real capital trading with a profit split—often between 70% and 90% in favor of the trader.

- The firm continuously monitors trading behavior to ensure compliance with rules.

- Any violation, such as exceeding drawdown or trading during restricted news events, can lead to account termination.

- Successful traders treat this stage like a professional partnership, focusing on consistency and long-term growth rather than short-term gains.

Step 5 – Profit Split and Payout Rules

The payout process varies among prop firms but generally follows a bi-weekly or monthly schedule. Traders receive their share via bank transfer, crypto, or payment platforms like Deel.

Common payout terms include:

-

Profit split: 70%–90% for the trader

-

Minimum withdrawal threshold: Often $100–$200

-

Scaling plans: Increased capital allocation after consistent performance

Top-tier firms like FTMO or The Funded Trader reward consistent profitability by doubling account size periodically—encouraging sustainable trading growth.

Step 6 – Scaling Plan and Long-Term Growth

- A scaling plan allows traders to gradually increase their account size as they demonstrate consistency.

- For instance, if a trader maintains 10% profit every two months without breaking rules, the firm might scale the account by 25%–50%.

- This system benefits both sides: traders access larger capital, while the firm profits from steady performers.

- According to data from multiple firms, traders who follow scaling plans tend to have 40% higher long-term profitability.

- It’s a sustainable model for building a professional trading career.

Key Rules and Requirements Traders Must Follow

Every prop firm enforces strict risk management rules to protect its capital:

-

Daily loss limit: e.g., 5% of account balance

-

Maximum drawdown: usually capped at 10–12%

-

Trading days minimum: to prove consistency

-

News trading restrictions: some firms ban trading during high-volatility events

Following these rules shows professionalism. Most failed challenges happen not from bad strategies but from ignoring these risk limits. Discipline, not aggressiveness, defines a successful prop trader.

Common Mistakes During the Prop Firm Process

Common mistakes during the prop firm process that lead to failure, even among skilled traders, include:

-

Overleveraging or taking excessive risk, often in an attempt to recover losses quickly or chase profits, which increases the likelihood of hitting drawdown limits.

-

Revenge trading and trading emotionally rather than following a disciplined, pre-planned strategy.

-

Ignoring firm rules, especially regarding daily drawdown limits, trading hours, and maximum risk per trade.

-

Lack of adaptation to different evaluation phases or stages of the prop firm’s challenge.

-

Trading without a solid plan, poor risk management like failing to set stop-losses, and overtrading which leads to unnecessary exposure.

-

Not using tools like a trading journal to track decisions and emotions that help identify and control emotional biases.

Emotional trading often results in impulsive trades, increased risk-taking, and violation of firm rules. Key advice to improve success includes keeping a trading journal, adhering to a strict risk-per-trade ratio (typically 1–2%), focusing on process discipline over outcome, and maintaining a calm, methodical approach throughout the evaluation and funded trading phases.

Proper education, training, and realistic expectations about the prop process also significantly reduce the risk of failure.

Tips to Succeed in the Prop Firm Evaluation

-

Master one strategy before joining any prop firm.

-

Risk small—keep drawdowns under 3–4%.

-

Backtest your setup over multiple market conditions.

-

Avoid news spikes that may cause unpredictable volatility.

-

Treat the evaluation like a real account.

Consistency beats speed. Many traders who pass emphasize patience and rule adherence as the ultimate edge in funded trading.

Comparison of Prop Firm Processes

| Prop Firm | Challenge Phases | Profit Split | Scaling Plan | Evaluation Time |

|---|---|---|---|---|

| FTMO | 2 | Up to 90% | Yes | 30 days + 60 days |

| The Funded Trader | 2 | Up to 90% | Yes | 35 days + 60 days |

| Fidelcrest | 2 | 80–90% | Yes | Flexible |

| MyForexFunds | (Discontinued) | 85% | Yes | 30–60 days |

Different firms have unique rule sets, but the core prop firm process remains similar: evaluation, verification, funding, and scaling.

What Happens After You Get Funded?

After getting funded by a proprietary trading firm, traders can trade with the firm’s capital in real markets and withdraw profits regularly. However, maintaining a funded account requires adherence to strict rules, including maximum drawdown limits, daily loss limits, and trading within permitted hours.

Violating these rules, such as exceeding allowed drawdowns or trading outside specified times, can lead to account suspension or disqualification.

Traders do not owe money to the firm if they lose capital; losses are absorbed by the prop firm. The key is disciplined trading and risk management to avoid breaching firm-set limits. Many prop firms require traders to manage drawdowns carefully by lowering risk per trade as losses increase to keep the account sustainable.

Top performers often reinvest profits to grow their accounts or diversify by trading with multiple prop firms to reduce reliance on a single funding source and maximize earning potential. Consistent profitability and careful risk management are essential to keep the funding, withdraw profits, and potentially scale trading capital over time.

In summary:

-

After funding, traders trade live with real capital and can withdraw profits.

-

Strict risk and trading rules must be followed; violations can cause loss of funding.

-

Traders are not personally liable for losses beyond initial evaluation fees.

-

Managing drawdowns and risk conservatively preserves the account.

-

Diversifying across multiple prop firms and reinvesting profits are common strategies for growth

Conclusion

The Prop Firm Process plays a crucial role in identifying skilled and disciplined traders capable of managing large capital responsibly. It ensures that only traders who consistently adhere to strict risk management and profitability targets gain access to funded accounts. This structured approach not only protects the firm’s capital but also provides traders a valuable opportunity to trade professionally without risking personal funds. Mastery of the Prop Firm Process opens the door to sustainable profit sharing and a career in proprietary trading.

Read more: