When entering the stock market, you’ve likely been overwhelmed by the sheer number of important terms, including stock market index that you need to understand thoroughly. Because stock market index will help you a lot in seizing high-profit opportunities. So, What is stock market index? Important types of stock market index that investors need to know? Let’s learn more with us through the content of the article!

What is Stock Market Index?

Stock market index is a statistical value that reflects the situation of a group of securities in the stock market. Stock indices will include stocks that share similarities such as:

- Being listed on the same stock exchange

- Belonging to the same industry

- Having the same market capitalization

These stock indices can be defined by stock exchanges, information companies, or financial institutions.

For example: The VN30 index of Vietnam is calculated based on the 30 companies with the highest market capitalization on the Ho Chi Minh City Stock Exchange (HOSE).

>>See more:

- What is Stock Liquidity? Why It’s Important for Investors

- What are stock exchanges and how do they work?

- Understanding Dividend stocks and how to invest in them

- What Is Stock Valuation? Notes When Valuation Of Stocks

Why Is It Important to Track Stock Market Indexes?

Monitoring stock market index is a very important task for both individual investors and financial institutions. Below are the main reasons explaining why:

Firstly, stock market indexes help investors, experts, and economic researchers analyze and evaluate the stock market specifically and the economy in general.

Secondly, stock market indexes are often used to assess the performance of a stock market, compare the volatility of stock prices, and track market trends over a certain period.

In particular, stock market index influences decision-making, investment decisions, market performance, etc., allowing investors to make final stock orders.

Important Stock Market Indexes Every Investor Should Know

S&P 500

The full international name of this stock market index in English is the Standard & Poor’s 500 Stock Index. This is one of the types of indices based on the stock prices of a list of 500 companies that are considered to have the largest market capitalization, and are listed on the stock exchanges known as NASDAQ or NYSE.

The S&P 500 stock index is one of the most widely followed stock indices in the world due to its comprehensiveness and objectivity. The vast majority of investors regard it as a leading index for assessing the overall economy of the United States and also as the most reputable measure of the fluctuations in the U.S. stock market.

Dow Jones

The full name of this stock market index is the Dow Jones Industrial Average (abbreviated as DJIA) – this is an industrial average index, also known as Dow 30.

This index was created in the 19th century, founded by Charles Dow, who was a co-founder of Dow Jones & Company and also the owner of the economic newspaper The Wall Street Journal. The Dow Jones index can be determined based on the closing prices of about 30 blue chip stocks.

Nasdaq

This is one of the largest stock exchanges in the United States, seemingly second only to the NYSE in New York, and was established precisely in 1971 by the National Association of Securities Dealers, commonly known as NASD.

The Nasdaq Composite is a type of index representing over 3,000 companies from various sectors such as technology, industry, consumer goods, and oil and gas, among others. Among them, the Nasdaq 100 index represents the top 100 companies specializing in technology with the largest market capitalization, and it is also listed on the Nasdaq stock exchange.

While the Nasdaq Composite index attracts the attention and monitoring of the majority of investors, the Nasdaq 100 index (NDX) is one of the major market capitalization indices specifically used to track the largest non-financial companies in the United States.

FTSE 100

The FTSE 100 is one of the stock indices classified as blue-chip, consisting of the 100 companies with the largest market capitalization in the UK. This index is also listed on the London Stock Exchange. It is a stock index that many investors are interested in and aim to participate in.

To invest in the FTSE 100, the constituent companies must meet all the following requirements:

- Have shares listed on the stock exchange in London, with prices quoted in British Pounds or Euros.

- The level of stock price volatility must be free, liquid, and the nationality must comply with the established requirements.

Although the constituent companies may include parent companies located in other countries, most indices will only consist of subsidiaries based in the UK and are influenced by the economy and politics of the UK.

CAC 40

CAC 40 is a stock market index that is the most popular in France. This index includes the 40 largest stocks based on market capitalization and liquidity in the current market. While the CAC 40 index is almost exclusively composed of companies based in France, its multinational scope makes it one of the most popular stock indices in Europe for foreign investors.

CAC 40 was officially launched on December 31, 1987, with an initial base value calculated at 1,000. After reaching an all-time high of nearly 7,000 during the dot-com boom in 2000, the index began to decline sharply to around 3,000 during the economic crisis and recession in 2011 before recovering to about 5,000 around 2017 and 2018.

Several other indices, including CAC Next 20 and CAC Mid 60, were announced alongside the CAC 40 and have become extremely popular in the markets for both domestic and international investors.

DAX 30

The DAX 30 index, also known in full English as the Deutscher Aktien IndeX 30 or Deutscher Aktien-Index 30, is a global stock index considered the most important one on the Frankfurt Stock Exchange. It is calculated based on the total of 30 blue-chip stocks that are traded on the Frankfurt Exchange.

Nikkei 225

The Nikkei 225 stock index, fully known in English as the Nikkei 225 Stock Average, is commonly referred to as the Nikkei index. This is one of the indices in the Japanese stock market.

This index reflects the market capitalization of a total of 225 leading companies in Japan, among which are several types of stocks currently being traded on the stock markets in Tokyo.

This stock index is also considered a measure of the stock market as well as the economy in Japan specifically and Asia in general. Some notable companies included in this index are: Toyota Motor Corporation (7203), Canon Incorporated (7751), and Sony Corporation (6758).

Hang Seng Index

The Hang Seng Index is one of the stock indices established and built based on a total of 40 largest companies located in Hong Kong.

This index records the daily or hourly changes of the largest enterprises present in the Hong Kong stock market, and it is also the main index that most clearly reflects the current operational situation of the entire economic market in Hong Kong.

The total of these 40 companies represents about 65% of the total market capitalization of the entire Hong Kong stock market.

Where to Watch Stock Market Indexes?

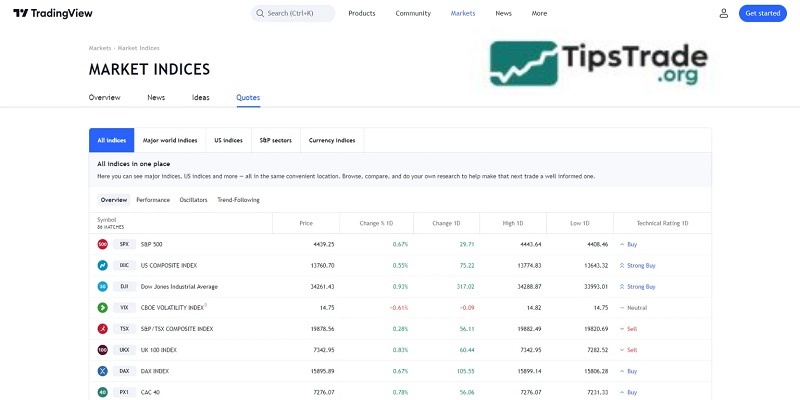

Today, the internet has made it convenient and quick to view stock market indexes. There are many financial websites that provide information on stock market indexes. Accordingly, investors can track the fluctuations of stock market indexes on well-known and reputable financial websites such as: Yahoo Finance, Bloomberg, Investing.com, or TradingView,…

Conclusion

Above are the information about what stock market index is, and the top 8 important stock market indexes that you need to know. We hope this information will provide you with useful knowledge. Wishing you success!