In the financial market, one of the prominent trading styles that many traders are interested in is trading in an offensive style – a proactive strategy that seeks quick advantages instead of waiting passively. However, to achieve success, traders need not only strong analytical skills but also effective psychological and risk management. In the following article, Tipstrade.org will provide a deeper analysis of the nature of this trading style, how to strike a balance between “offense” and “defense,” as well as the crucial role of psychology in the decision-making process. Let’s get started!

The nature of trading in an offensive style

Trading in an offensive style is not simply about opening orders continuously or placing large bets. Its essence lies in the ability to seize market opportunities at the right time, based on clear analysis and confidence in the chosen strategy.

In sports, the team that wants to score must take the initiative to attack, create pressure, and capitalize on the opponent’s mistakes. In trading, it’s the same for traders: they need to actively “score points” with quick decisions, but at the same time, they must maintain discipline to avoid self-sabotage.

This shows that trading in an offensive style is inseparable from the defensive element. A good trader is someone who knows both when to “attack” to maximize profits and when to “defend” to minimize risk.

>>See more:

- How to Refine Forex Strategy for Better Trading Performance

- Copy Trade Forex: Key Tips to Maximize Your Profits

- News Trading Forex Strategies for Beginners

- How to Adjust Forex Strategy to Maintain Trading Efficiency

The balance between trading in an offensive style and defense

In football, a strong team must be good at both offense and defense. Similarly, in trading, trading in an offensive style cannot be completely separated from defensive strategy.

Attack: the profit-scoring strategy

- Actively seek opportunities: Traders often analyze charts, determine early entry points to take advantage of trends.

- Maximize profit: When the market is moving in the right direction, an aggressive style helps increase position and optimize results.

- Create a psychological advantage: Success in accurate attack orders helps traders to be more confident in the trading process.

Defense: protecting against risk

- Set reasonable stop-loss: Don’t let one wrong order “burn” your account.

- Controlling trading volume: Always calculate the appropriate capital ratio for each order.

- Emotional management: Understand your own fear and greed so you don’t get carried away by the market.

The harmonious combination of these two factors helps traders both score points and avoid defeating themselves.

The meaning of “Lose small to win big”

For trading in an offensive style, it’s not always possible to win. It’s important to know how to accept small losses in order to conserve resources for bigger opportunities.

For example: A trader might cut their losses early when they see the market moving against them, instead of trying to hold onto the position. Although they lost a small amount, this action helped them maintain a stable mindset to pursue other opportunities.

This approach not only protects accounts but also enhances long-term sustainability.

Psychology in trading in an offensive style

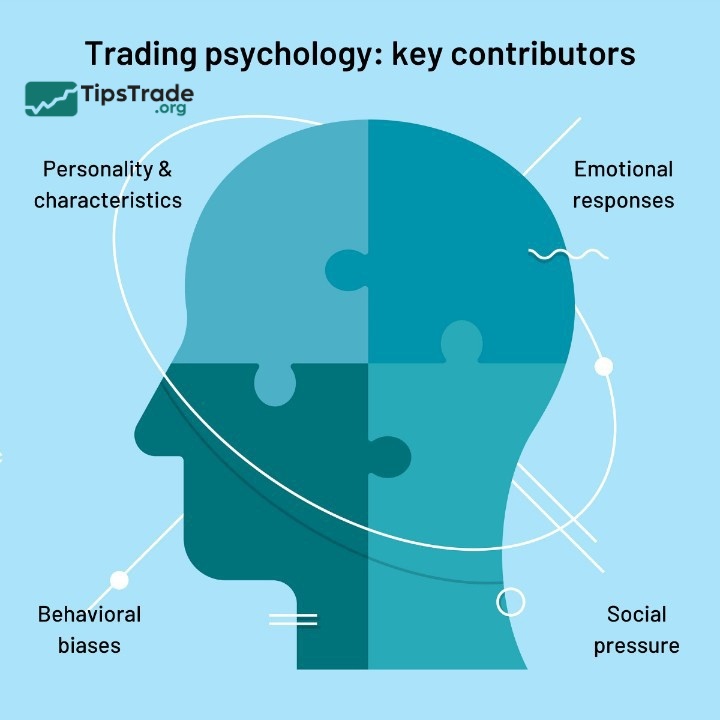

One of the biggest challenges of trading in an offensive style is not technical, but psychological. Traders often fall into a state of stress, fear or greed, which causes them to make decisions without control.

Understand your own emotions

Psychological research shows that recognizing and naming emotions can help people better control their behavior. When traders know they are anxious, angry, or overly excited, they can adjust their decisions to avoid risks.

For example:

- A series of losing orders can easily cause traders to lose their composure and try to recoup.

- A big winning trade can cause traders to get excited and overtrade.

Recognizing these emotions in a timely manner is an important “defensive shield” during trading in an offensive style.

Emotional management

It is impossible to completely eliminate emotions from trading, but traders can learn to turn emotions into useful information. Anxiety, for example, can sometimes be a warning sign that the market is not favorable. It is important to understand what those emotions are telling you rather than letting them blindly guide your actions.

How to trade more effectively in an offensive style

A helpful way to improve efficiency in aggressive trading is to review past mistakes.

- Ask yourself: Why did I open that order?

- What was I feeling at that moment?

- Did the mistake stem from technical analysis, money management, or emotions?

This analysis helps traders better understand their own strengths and weaknesses. Once the cause is identified, improvements will become clearer, such as:

- If the mistake is due to a lack of discipline, trading principles need to be reinforced.

- If you make mistakes due to emotions, you need to practice controlling your emotions.

- If the error is due to poor analysis, technical knowledge needs to be supplemented.

Practical lessons on trading in an offensive style

Imagine the market as a football match. When trading in an offensive style, the trader plays the role of both a forward trying to score and a defender protecting the goal.

- Attack: Clear tactical planning, find reasonable entry points.

- Defense: Protect your account from unpredictable fluctuations.

- Coach: It’s the mindset and strategy that traders set for themselves.

Successful traders don’t just rely on their ability to score goals, but also on preventing themselves from making mistakes. This is like a strong team that not only scores many goals but also keeps a clean sheet.

Final thoughts

In summary, trading in an offensive style is a challenging but also potentially rewarding option. It requires proactivity, discipline, and a combination of technical analysis skills and emotional management. A successful trader not only knows how to attack to seek profit but also how to defend to protect themselves. And once the nature of this trading style is fully understood, by maintaining a balance between offense and defense, along with analyzing psychology and mistakes, traders can improve their trading efficiency and build sustainable growth in the market. Wishing all traders successful trading!

See more: