What is volatile forex market? This is an important concept to know if you are interested in the foreign exchange market. In the article below, let’s explore the specific classifications of the volatile forex market, its meaning, as well as the factors that affect the volatile forex market,…with Tipstrade.org to gain more useful information.

What is volatile forex market?

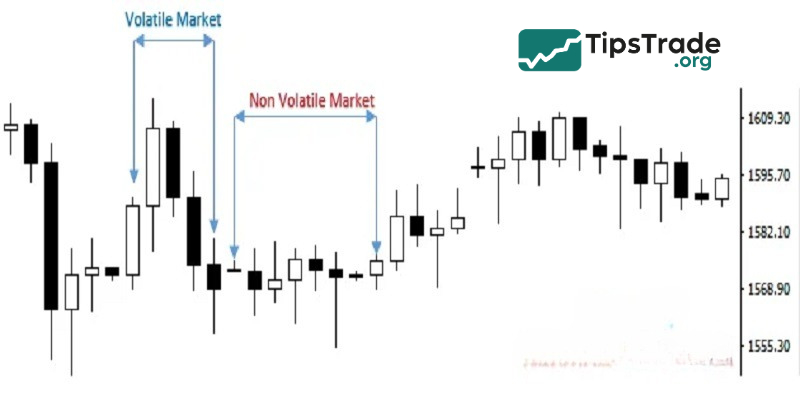

This is a core concept in the forex market, helping traders assess the risk and profit potential of a trade. Accordingly, volatile forex market is the rate at which the price of currency pairs changes over a given period of time.

Volatility is expressed in price ranges. For example, if EUR/USD moves from 1.1200 to 1.1250 in a day, that is a 50 pip move. GBP/JPY can move more than 150 pips in the same time period. So GBP/JPY is the more volatile forex pair.

>>See more:

- What is Forex? The Complete Guide for Beginners

- Understanding Forex Market Reaction to Unexpected News

- Revealing 5 Tips To Forex Account Protection Safe For Traders

- Understanding Market Trends In Forex And How to Identify Them

How are the volatile forex market and liquidity related?

The volatile forex market and liquidity are like two sides of the same coin. Because:

- When liquidity is high: Prices tend to move within a narrower range because many buy and sell orders are balanced.

- When liquidity is low: Prices are easily affected by a few large orders, leading to strong and unpredictable fluctuations.

For example, during the European and US trading sessions, forex market liquidity is typically at its highest due to heavy participation from financial centers. Conversely, during weekends or major holidays, liquidity is lower and price movements can become erratic.

Types of volatile forex market

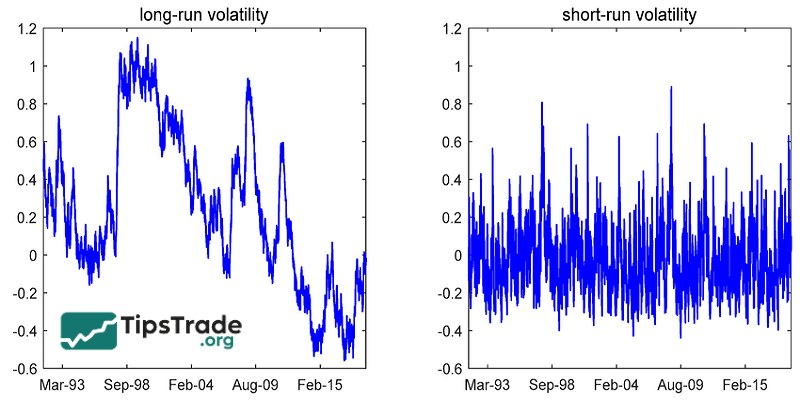

As the name suggests, the Forex market is a world of constantly fluctuating currencies. These fluctuations, measured by the change in value of one currency relative to another, influence the dynamic nature of the Forex market. Understanding the different types of volatile forex market, especially the difference between short-term and long-term volatility, is key for anyone entering the world of Forex trading.

Short-term volatility

Short-term volatility refers to small and frequent changes in the value of a currency, which can occur within a day or even an hour. These fluctuations can be caused by a variety of factors, including economic news releases, central bank interventions, immediate supply and demand in the market, and geopolitical events. Short-term traders operate on these small movements and aim to profit from intraday price fluctuations. The ability to react quickly and be flexible is essential in this form of trading.

Long-term volatility

In contrast to short-term volatility, long-term volatility reflects more significant changes in the value of a currency over months or even years. These fluctuations are largely driven by fundamental factors such as economic policies, inflation rates, economic growth rates, and political stability of countries. Long-term traders make decisions based on the overall economic outlook and long-term market trends. They focus less on daily fluctuations and more on the overall movement of prices over a long period of time.

Why does volatile forex market matter in trading?

Forex traders cannot ignore the volatile forex market. Because, it directly affects every trading decision:

- Risk measurement: The higher the volatility, the higher the risk. Even a small move can wipe out an account if money is not managed properly.

- Choose the right strategy: Scalpers and day traders usually prefer volatile markets to find short-term swings. On the contrary, swing traders and position traders prefer more stable volatility.

- Optimizing profits: Understanding the volatile forex market helps to choose the right currency pair and trading time, avoiding falling into the “static” market period.

- Psychological impact: Strong fluctuations can make traders excited or panicked. Only those who can control their emotions can seize opportunities from volatility.

Key factors affecting volatile forex market

Below are the key factors that cause changes in the volatile forex market and their impact:

Economic news and data

Economic events are the top causes of increased volatile forex market:

- US employment report (Non-Farm Payrolls).

- Inflation index (CPI).

- GDP, PMI, consumer confidence index.

- In just a few minutes after the news, the price can move dozens to hundreds of pips.

Monetary policy and central banking

Interest rate decisions from the FED, ECB or BOJ all directly affect forex movements. When interest rates change, the value of currencies also changes.

Political and geopolitical events

Wars, elections, debt crises… often make traders lose confidence in the currency of the country involved, thereby causing volatility to spike.

Liquidity and trading sessions

Volatile forex market is not uniform during the day:

- Asian Session (Tokyo): low volatility

- European Session (London): more volatile

- US Session (New York): highest volatility, especially when coinciding with the European session.

How to measure volatile forex market

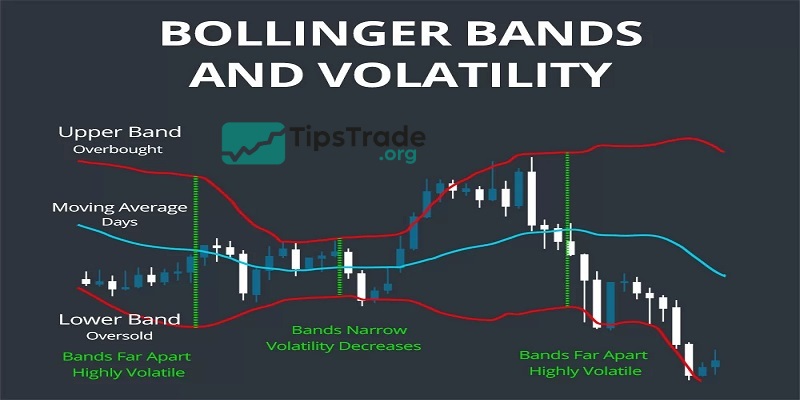

Traders have many tools to measure volatile forex market:

- ATR (Average True Range): Measures the average range of oscillations. If ATR increases, the market is highly volatile.

- Bollinger Bands: When bands expand, forex volatility increases. When bands narrow, the market is moving sideways.

- Standard Deviation: Statistics of price dispersion around the mean.

- Historical Volatility (HV): Measure past fluctuations.

- Implied Volatility (IV): Reflects expectations of future volatility (often used in options but forex traders can refer to it).

In addition to the tools mentioned above, other useful tools such as the Myfxbook Volatility Calculator or TradingView will help traders visualize the volatile forex market more effectively.

Currency pairs have different levels of Forex volatility

Not all currency pairs are equally volatile. Some pairs are highly volatile due to external factors or large differences between two economies.

Highly volatile currency pairs

- GBP/JPY, GBP/USD, XAU/USD (gold): fluctuates strongly daily, suitable for adventurous traders.

- AUD/JPY, NZD/JPY: sensitive to global news, especially commodities.

Low volatility currency pair

- EUR/CHF, USD/JPY: more stable, suitable for traders who want safety.

Choosing currency pairs based on the volatile forex market will help traders match their personal style.

>>See more: What are forex currency pairs? Top 10 best forex currency pairs to trade

Trading strategies for volatile forex market

When volatility is high

- Scalping & Day trading: taking advantage of short waves.

- News trading: trading immediately after news is released.

- Note: Wide spread, high risk of slippage.

When volatility is low

- Swing trading: holding orders for several days to several weeks.

- Carry trade: taking advantage of interest rate differentials.

- Note: Be patient, as the market can easily go sideways for a long time.

Managing capital based on volatile forex market

- Set stop-loss based on ATR to match actual volatility.

- Increase or decrease trading volume based on volatility.

- Avoid overtrading when volatility is too high.

Psychology and risk management in times of volatile forex market

Many traders fail not because they lack a strategy, but because they can’t control their emotions when the market fluctuates. Some important principles:

- No FOMO: Large fluctuations can easily create the illusion of opportunity, but they also contain potential price traps.

- Absolute discipline: Always stick to the trading plan, do not arbitrarily change the stop-loss.

- Standing aside when needed: Not trading is also the right decision during unpredictable periods of volatility.

Final thoughts

Thus, in the article above, we clarified the concept of the volatile forex market and its importance in trading. Hopefully, through this article, readers will have more information to come up with suitable investment ideas for themselves. Follow Tipstrade.org now to stay updated on the latest trading experience articles!