Forex market liquidity plays a crucial role in financial trading. High liquidity allows traders to execute buy and sell orders quickly at the best prices, thereby optimizing profits and effectively managing risks. By understanding forex market liquidity, traders can assess order execution capabilities, take advantage of market opportunities, and make informed trading decisions. Let’s explore this topic together with Tipstrade.org in this article.

Understanding forex market liquidity

What is forex market liquidity?

In the financial markets, Liquidity is simply understood as the ability to buy and sell an asset without significantly changing its price. When we talk about forex market liquidity, we are talking about the ability to convert currency pairs into cash or into other currencies easily, quickly and with little spread.

The forex market is considered the most liquid market in the world, with a daily trading volume of more than 7 trillion USD. The reasons come from:

- Forex operates 24 hours a day, 5 days a week, allowing global traders to participate continuously.

- Many participants include central banks, financial institutions, hedge funds and individual traders.

- Huge trading volume, especially focused on major currency pairs such as EUR/USD, GBP/USD or USD/JPY.

As a result, the forex market rarely falls into a state of “no buyers or no sellers”.

>>See more:

- What is Forex? The Complete Guide for Beginners

- Understanding Forex Market Reaction to Unexpected News

- The Impact of Central Bank vs Forex – Understand to Invest Effectively

- Interest rate forex impact: How it affects currency value

Why is forex market liquidity important?

Forex market liquidity is not only a measure of market activity but also directly affects transaction costs and trader experience.

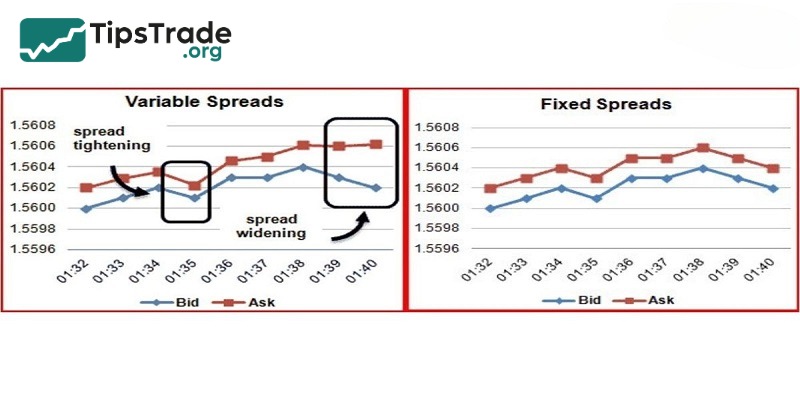

- Lower spread: When liquidity is high, the spread between the buy and sell price is usually very small. This helps traders save costs when entering and exiting orders.

- Fast order matching: With high trading volume, buy or sell orders are almost instantly executed at the desired price.

- More stable price movements: A liquid market is less likely to experience large swings caused by a single large order. Prices are less likely to make sudden “jumps”.

- Slippage limitation: In a liquid market, the possibility of orders being filled at a less favorable price is minimized.

Conversely, when Forex market liquidity is low, spreads can widen, prices fluctuate widely, and traders are exposed to more risk.

Relationship between forex market liquidity and volatility

Forex market liquidity and volatility are like two sides of the same coin. Because:

- When liquidity is high: Prices tend to move within a narrower range because many buy and sell orders are balanced.

- When liquidity is low: Prices are easily affected by a few large orders, leading to strong and unpredictable fluctuations.

For example, during the European and US trading sessions, forex market liquidity is typically at its highest due to heavy participation from financial centers. Conversely, during weekends or major holidays, liquidity is lower and price movements can become erratic.

Key factors affecting forex market liquidity

Here are some key factors that may affect forex market liquidity:

Trading hours of financial centers

Forex operates 24/7 but liquidity varies from hour to hour. When London and New York are open at the same time, trading volume increases dramatically, providing ample liquidity.

Currency pairs

Major pairs such as EUR/USD, GBP/USD, USD/JPY usually have the highest liquidity. Meanwhile, cross pairs or exotic pairs have lower liquidity, resulting in wider spreads and higher volatility.

Economic and political events

Major news events such as interest rate announcements, employment reports, or geopolitical events can cause sudden changes in forex market liquidity. Prices often fluctuate wildly before and after the news, even beyond normal liquidity levels.

Participation of major organizations

Trading activity from central banks, hedge funds and global financial institutions significantly impacts liquidity flows. Large volume orders can temporarily boost or reduce liquidity.

How to measure forex market liquidity

After understanding its important role, you now need to know how to measure forex market liquidity. While it’s crucial for market conditions, it also helps in making informed trading decisions. Several metrics are used to assess forex market liquidity:

- Bid-Ask Spread: A narrower spread usually reflects a market with many buyers and sellers, meaning high liquidity. Conversely, when the spread widens, it indicates low liquidity and transaction costs may increase.

- Trading volume: On many platforms, you can track the volume of orders executed. The higher the volume, the more active the market, indicating strong liquidity.

- Consider the time of day: Liquidity varies by time frame. Typically, the period when major sessions such as London and New York open together is when liquidity is strongest, while weekends or Asian sessions are usually less active.

- Combined with economic news: Major events such as interest rate announcements, employment reports, or important political-economic news can cause large short-term liquidity swings. When big news occurs, volume and volatility tend to increase.

Effective forex market liquidity strategies

Trend Following

This strategy is based on a simple but powerful principle: “The trend is your friend”. The trader will identify the main trend of the market – up, down or sideways – and place a trade in that direction.

Advantages of applying Trend Following in Forex market liquidity:

- Easy to identify trends thanks to clear price data and large trading volume.

- Take advantage of the power of large cash flow, helping to minimize the risk of unexpected reversals.

- Maximize profits by holding orders in the direction of the main trend until there is a clear sign of reversal.

Scalping

Scalping is a very short-term trading strategy, especially suitable in Liquid Markets due to high liquidity and extremely low spreads. In this method, the trader makes dozens or even hundreds of small trades per day, with the goal of profiting from very small price movements, just a few pips or a few cents per trade.

Advantages of Scalping in Forex market liquidity:

- Low spreads optimize profits from very small price movements.

- Ability to exit orders quickly thanks to a large number of buyers and sellers.

- Lower risk because each trade is short term, avoiding sudden large fluctuations.

Important factors when scalping:

- A fast internet connection and a smooth trading platform are required.

- Tight risk management skills (use stop-loss).

- Highly disciplined mentality, avoid “overtrading”.

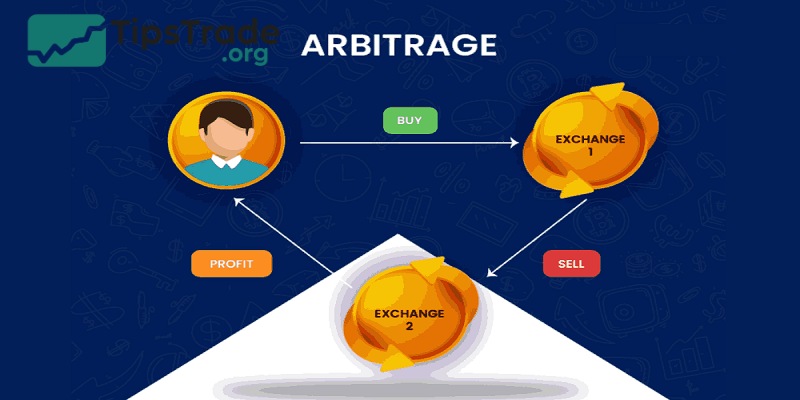

Arbitrage

Arbitrage works on the principle of exploiting the price difference of the same asset between two or more different exchanges. Traders will buy assets at the exchange with a lower price and simultaneously sell them at the exchange with a higher price, thereby profiting from the price difference. This is a fairly safe strategy, because buying and selling take place almost simultaneously, helping traders limit the risk of price fluctuations.

In Forex market liquidity, Arbitrage is particularly effective due to several key factors. First of all, the fast trading speed allows for near-instant execution of buy and sell orders, minimizing the possibility of price fluctuations that could result in losses. Additionally, the large trading volume allows for significant Arbitrage without significantly affecting the market price.

Finally, the small spreads in Forex market liquidity make it easier and more frequent to spot and exploit price differences between exchanges, creating more safe profit opportunities for investors.

Managing risks in low liquidity conditions

It is important to be cautious when forex market liquidity is low as it can make trading more difficult. Some ways to help include:

- Avoid trading off-peak hours: Avoid trading on weekends or late at night when the number of traders is low.

- Use a limit order: Instead of entering an order immediately, place a limit order to execute the trade at a desired price. Limit orders allow you to specify the exact price at which you want to enter or exit the trade, giving you more control over the execution of your order.

- Trade in smaller volumes so that your orders do not impact the market too much.

- Keeping a close eye on large price movements can leave you stranded if liquidity suddenly drops sharply.

- Consider waiting for better conditions rather than taking on additional risk when trading volume is too low.

Taking these steps will help ensure your trades don’t get into a situation where it’s difficult to exit quickly if liquidity drops at an unfavorable time.

Final thoughts

Forex market liquidity is not simply about the speed of order execution. It is also an important factor that helps traders control risk and optimize profits. Mastering forex market liquidity knowledge, including influencing factors and how it fluctuates, will help you make smarter trading decisions, from choosing the right currency pairs to determining effective trading times.