Refine forex strategy is one of the essential actions that help traders maintain a competitive edge in the volatile foreign exchange market. Regularly reviewing, optimizing, and applying new trading methods will open up opportunities for traders to enhance their trading performance. So, how can one improve outdated Forex strategies? Let’s explore the details together with Tipstrade.org in the following articles!

Why Is It Important to Refine Forex Strategy Regularly?

Any strategy is built on certain assumptions about market behavior. However, the forex market is always influenced by:

- Global economic fluctuations: Events such as interest rate changes, economic data, or geopolitical news.

- Market cycles: Periods of strong trends, sideways phases, or low volatility phases.

- Trader sentiment: The market can change rapidly when sentiment shifts from optimism to pessimism or vice versa.

Therefore, if traders do not refine forex strategy regularly, they are likely to fall into the trap of applying old models to new conditions, resulting in decreased performance.

>>See more:

- What is Forex? The Complete Guide for Beginners

- How to Adjust Forex Strategy to Maintain Trading Efficiency

- Forex strategy: Top 10 most effective strategies for beginners

Factors to consider when refining a forex strategy

When refine forex strategy, traders should consider the following factors:

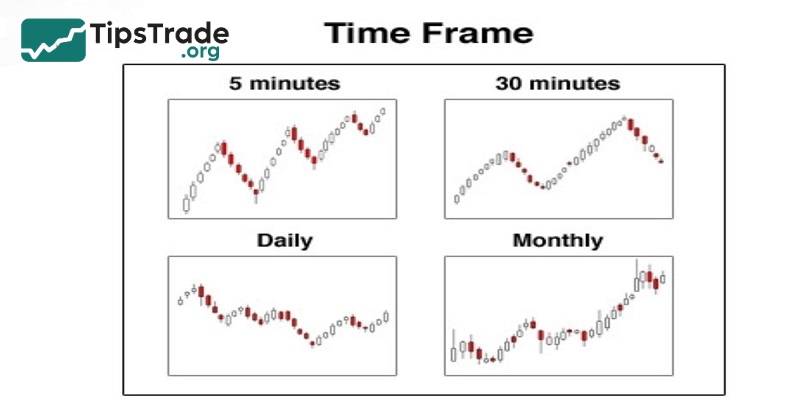

Trading time frame

A strategy that works on the H1 timeframe may not be suitable when applied to the D1 or M15 timeframe. Testing on multiple timeframes helps determine which is optimal.

Market conditions

Trend following strategies work well when the market is trending, but are less effective in sideways periods. On the other hand, range trading strategies work well when the market is moving sideways.

Risk management

A good strategy should be accompanied by effective risk management. Improving your forex strategy should not only be about entry/exit points, but also include adjusting risk ratios, stop-loss and take-profit levels.

Effective methods for refining forex strategies

Refine forex strategy is essential, however to improve effectively, traders need to understand the following methods:

Backtesting and data analysis

Backtesting helps you test the performance of your strategy on historical data. This way, you can assess whether your current strategy is still relevant or needs to be changed.

For example, if a scalping strategy yields a 60% win rate in 2020–2021 but drops to 45% in 2023–2024, this is a signal for improvement.

Combining multiple indicators

Instead of relying on just one technical indicator, combining 2–3 complementary indicators can help reduce the noise. For example, combine RSI with MACD to confirm entry points, or use Fibonacci Retracement to find support/resistance zones.

Adjust according to the time of day

Some currency pairs are more volatile during the London session, while others are more active during the New York session. Improving your forex strategy by focusing your trading during high volatility hours will help increase your performance.

Optimizing entry/exit points

Instead of entering the trade as soon as the signal appears, you can wait for further confirmation from the next candle or from an additional indicator. This helps reduce the risk of getting caught in a false breakout trap.

Flexible combination of fundamental analysis

Technical analysis provides signals, but fundamental analysis helps explain the reasons for the movements. Combining the two gives you a more complete picture, making the strategy more sustainable.

Common Types of Strategies That Can Be Refined

Swing Trading

- Features: Hold orders for several days to several weeks to take advantage of medium-term price fluctuations.

- Refinements: Use additional Fibonacci zones to determine reasonable retracement points, or combine economic news analysis to confirm trends.

Day Trading

- Features: Same day trading, no overnight hold.

- Refinements: Focus on active time frames, optimize entry points using M5 or M15 charts to reduce risks.

Scalping

- Features: Execute many small orders during the day, each order only holds for a few seconds to a few minutes.

- Refinements: Use a platform with fast execution speeds, low spreads and leverage tick data for quick decisions.

Breakout Trading

- Features: Trade when price breaks an important support or resistance zone.

- Refinements: Add volume filter to confirm breakout strength, avoid price trap.

Price Action

- Features: Pure price movement analysis without much reliance on indicators.

- Refinements: Combine Japanese candlestick patterns with important support/resistance levels and news data for increased accuracy.

Key Steps to Refine Forex Strategy

To optimize trading efficiency, traders need to follow a systematic process. Refining a forex strategy is not just about random changes, but calculated adjustments based on real data. Here are the important steps:

- Step 1: Identify the problem – What is the strategy’s limitation? Is the win rate decreasing, entry points not optimal, or is risk management poor?

- Step 2: Data Collection – Get data from trading history, win rate statistics, profit/risk levels.

- Step 3: Suggest changes – Add/remove indicators, adjust trading times, or change money management rules.

- Step 4: Backtest and forward test – Test on historical data and demo account.

- Step 5: Practical Application – Start with small volumes before trading large.

- Step 6: Continuous Evaluation – Over time, analyze the results and continue to adjust.

Common Mistakes When Refining Forex Strategy

In the process of refining forex strategy, many traders – especially beginners – often make common mistakes that make the strategy refinement less effective or even counterproductive. Here are some common mistakes to avoid:

- Changing too many factors at once: Making it difficult to determine the cause of improved or declining performance.

- Ignoring the psychological factor: Even with a good strategy, weak trading psychology can lead to poor results.

- Not testing long enough: It takes at least a few dozen trades to evaluate effectiveness after adjustments.

Final thoughts

In the article above, Tipstrade.org has just provided you with some methods to refine forex strategy effectively. We hope that the information shared in the article has brought you useful knowledge. Continue to visit our website to update other useful investment knowledge!