Adjust forex strategy is an essential step for every trader who wants to maintain consistent trading efficiency in the volatile forex market. A well-structured adjustment process not only helps you adapt to market changes but also minimizes risks and maximizes profits. In this article, we will explore practical ways to adjust your forex strategy and ensure long-term success.

Why do traders need to adjust forex strategy?

The foreign exchange market changes every hour. Price volatility, liquidity, macroeconomic factors, and even trading psychology can all cause a system that once performed well to suddenly become less accurate. Sticking to a fixed strategy while the market has changed is why many traders experience prolonged losses.

The key to adapting and overcoming those difficult phases is to flexibly adjust forex strategy, with a clear database and monitoring. This includes both changing trading techniques and re-evaluating timeframes, profit targets, risk ratios, and personal psychology.

>>See more:

- What is Forex? The Complete Guide for Beginners

- Important Economic Indexes Every Trader Needs To Know

- Understanding Market Trends In Forex And How to Identify Them

- Forex Risk Limits – A Complete Guide for Traders

The importance of tracking trading performance

One of the most important foundations in the process of adjust a forex strategy is to systematically monitor your trading performance. You cannot improve what you cannot measure. Without a clear understanding of how your current strategy is performing, any adjustments will be subjective and prone to errors.

To make the adjustment process accurate and effective, you need to regularly monitor the following indicators:

- Win Rate: Indicates the probability of a trade succeeding. If this ratio is too low, the strategy may need to change its entry points or signal confirmation conditions.

- Drawdown: This is an important indicator to measure risk. A profitable strategy but with too deep a drawdown can affect the trader’s psychology and tolerance level.

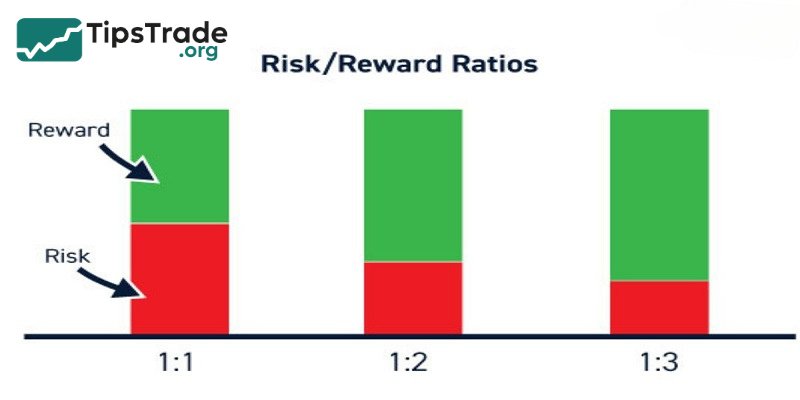

- Risk/Reward ratio (Actual R:R): Compare the expected profit and the actual risk of each trade. If the R:R is lower than expected, you should reconsider how you set your profit target or stop loss.

A useful tool to help you track these metrics is a trading journal. By recording trade entries, results, and emotions in detail, you can identify weaknesses in your system early on and adjust forex strategy more flexibly and realistically.

When should traders adjust forex strategy?

A strategy doesn’t always need to change. However, here are clear warning signs that it’s time for you to seriously adjust forex strategy:

- The losing streak continues even though you are still following the trading rules correctly.

- Market structure changes significantly, no longer suitable for the current system (e.g., from trending to sideways).

- The strategy is no longer suitable for the individual’s schedule or mental state.

- Trading performance is gradually declining, and the drawdown is exceeding control limits.

Timely detection of these signals will help you avoid significant losses and provide an opportunity for timely adjustments.

How to adjust forex strategy effectively

Many traders find it difficult and troublesome because they do not know where and how to adjust their strategies effectively. Let’s refer to the simple yet effective methods below, summarized from the experiences of successful traders who have gone before:

Refine trading time

Not every time frame of the day offers the same probability of success. Traders can try adjusting their forex strategy by focusing on high-liquidity sessions such as the London and New York sessions, where market movements are often more volatile and signals clearer.

Simplify the analysis system

An overly complex strategy with too many indicators can easily cause confusion and conflicting signals. Instead, keep your system simple with core indicators you trust. This not only reduces errors but also improves reaction speed.

Review the Risk-to-Reward ratio

A strategy with a profit-to-risk ratio below 1:1.5 often struggles to be effective in the long run. Adjusting a forex strategy by modifying take-profit levels or tightening stop-losses based on indicators such as ATR is a practical way to improve R:R while still keeping risks under control.

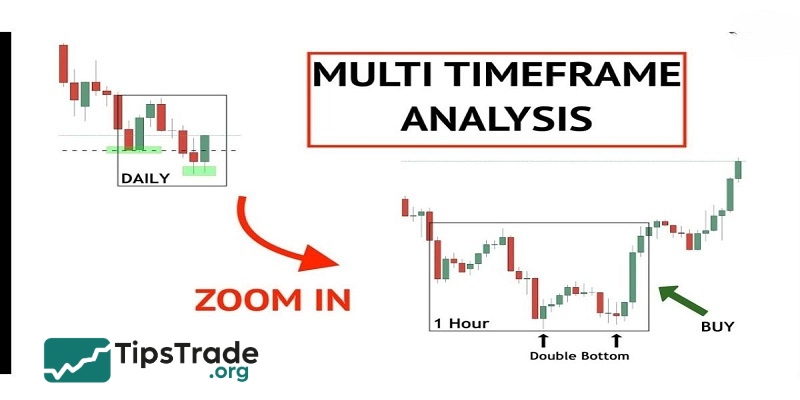

Experiment across multiple timeframes

Not every strategy works well on all timeframes. Try backtesting and forward testing on H1, M15, or D1 to determine which timeframe best fits your system.

Adjust according to psychology and lifestyle

If you no longer have the patience for long-term swing trading, consider adjusting your forex strategy to shorter-term or intra-day trading. Aligning your strategy with your personal trading psychology is a key factor in maintaining discipline.

FAQs about adjust forex strategy

Should you change your strategy after just losing a trade?

You shouldn’t. A losing order doesn’t say anything. The system should only be evaluated after at least 20 trades to clearly see the actual performance trend.

How often should you adjust your forex strategy?

There is no fixed timeframe. However, it is generally recommended to re-evaluate monthly or immediately after a major market event that causes significant volatility.

Should you copy someone else’s strategy?

It shouldn’t be applied to the original form. You can learn from others, but you should test and adjust your forex strategy so that it fits your own psychology, schedule, and reaction capability.

Final thoughts

In short, adjusting your forex strategy doesn’t mean you’re wrong, but rather demonstrates flexibility and evolution. No strategy is right all the time. Therefore, adjusting your forex strategy should be seen as part of a professional process to adapt to reality.