Forex backtest is an effective trading tool that every expert often uses to check whether their trading strategy is truly effective before risking real money. Let’s explore what is forex backtest, the types of backtesting, and how to perform forex backtest effectively with Tipstrade.org in the following article!

What is Forex Backtest?

Forex backtest is the process of testing and evaluating a forex trading strategy based on historical price data. In other words, the trader will apply his trading rules or strategy system to historical market data to see how the strategy works.

Forex backtest results will provide data such as: win rate, profit, loss, as well as risk indicators. Thereby, traders can clearly understand whether the strategy has potential or not before applying it to real trading.

For example, with a strategy of buying stocks when the MA50 line crosses the MA200, traders can use price data over the past 5 years to assess whether the method is still profitable.

>>Read more:

- What is Forex? The Complete Guide for Beginners

- What is Forex Technical Analysis and How Important is it?

- What is forex CFD: Key Benefits and Risks Explained Clearly

- Forex Bot Explained: A Complete Guide for Beginners

Why is forex backtest important for traders?

Many people think that forex trading is simply pressing the BUY SELL button. In fact, it is a process in which traders analyze and test strategies. Accordingly, forex backtest allows traders to rely on historical price data to test their trading strategies to:

- Evaluate your trading strategy in different market conditions to see if it is effective.

- Detect weaknesses or errors in the trading system.

- Adjust strategies before putting them into real trading.

- Practice disciplined and statistical thinking based on real data.

It can be said that forex backtest is a trading method that is both economical, safe and effective in practicing trading for traders.

Common forms of forex backtesting

Currently, there are 2 main forms of forex backtest that traders often use. These are:

Manual backtest

In manual backtesting, the trader will directly analyze the historical data by looking at the price chart and applying his trading strategy. For example, the trader can open the price chart on TradingView, rewind the time, and record the trades according to the strategy.

Benefits of manual backtesting:

- No programming skills required.

- Suitable for simple strategies.

- Helps you better understand market behavior.

Limitations of manual backtesting:

- Time consuming and laborious.

- Vulnerable to emotions or personal mistakes.

- Difficult to handle large volumes of data.

Automatic backtest

In contrast to manual backtesting, in automated backtesting, traders will use programming codes or software (e.g., Python, MQL4, or Pine Script) to test strategies based on historical data. Some popular trading platforms that traders often use when backtesting forex automatically include: MetaTrader, Amibroker, or TradeStation.

Benefits of automated backtesting:

- Fast and able to handle large volumes of data.

- Eliminates human error and emotion.

- Easily optimize strategic parameters.

Limitations of automated backtesting:

- Requires programming skills or software knowledge.

- Real-world factors such as slippage or transaction costs can be ignored.

How to perform forex backtest

To perform a quality forex backtest, you need to follow these steps:

Step 1: Define your trading strategy

First, traders need to have a detailed trading strategy with specific rules. These include:

- Entry point: When will you buy or sell?

- Exit point: When do you take profit or cut loss?

- Capital management: How much percentage of your account will you risk per trade?

Step 2: Gather historical data

The key to accurate forex backtesting is to collect high-quality historical data. Accordingly, traders can turn to the following reputable sources to get historical price data:

- Trading platforms: MetaTrader, TradingView, or Binance.

- Data provider: Quandl, Yahoo Finance, or Alpha Vantage.

- Note: Data should include open, close, high, low (OHLC) and volume.

Step 3: Select the right software or tools

Traders proceed to choose the appropriate forex backtest tool, based on the backtest type you have chosen (manual or automatic):

- For manual backtest: Excel, TradingView.

- For automatic backtest: Python (Pandas library, Backtrader), MetaTrader, Amibroker.

Step 4: Run your backtest

- If you choose manual backtest: Review each trade on the chart and record the results.

- If you choose automatic backtest: Write code or set up strategy on software, then run simulation.

Step 5: Analyze backtest results

Below are the important metrics that you need to analyze after completing the backtest:

- Net Profit: The final result (profit or loss) after all expenses are deducted. It is a goal, but not enough information.

- Profit Factor: Ratio of total gross profit to total gross loss. Indicates how effective the strategy is in turning risk into profit. A score > 1 is required.

- Maximum Drawdown: The biggest loss from the top of your capital to the bottom. This is the most important indicator of the risk that you need to prepare mentally and financially to face.

- Total Trades: A large enough number of transactions makes the backtest results more statistically significant.

- Win Rate (% Profitable): How often does a strategy generate profitable trades? Note: A high win rate does not guarantee a good strategy if the wins are much smaller than the losses.

- Average Profit/Average Loss: Comparing these two values helps to understand the strategy’s profit structure (win small but win big, or win large but win small and lose big?).

- Equity Curve: The graph visually shows the growth (or decline) of capital over time. A steady upward slope is a sign of a healthy strategy.

Step 6: Optimize and test again

After getting the forex backtest results, the trader can adjust the parameters (for example, change the RSI level from 30 to 25) and run the backtest again. However, the trader must be very careful not to encounter the case of overfitting. As a result, the strategy only works on historical data but fails in real trading.

Detailed guide to forex backtest on popular platforms

In the content below, Tipstrade.org will guide you through the detailed process of performing a forex backtest on MetaTrader 4 (MT4) with an Expert Advisor (EA) and on TradingView.

How to backtest an EA in MT4

Expert Advisor (EA), also known as Forex Robot, refers to automated trading software programmed in MQL4 language and running on the MT4 platform. By backtesting EA on MT4, traders will be able to evaluate the robot’s performance before putting it into use on a real account. The specific implementation process is as follows:

Step 1: Prepare EA and data

– Load or write EA: If you have an existing EA file (.ex4 or .mq4 format), save it to the MQL4/Experts folder in the MT4 installation directory.

– Download historical data:

- Open MT4, go to Tools > History Center.

- Select the currency pair or asset you want to backtest (e.g. EUR/USD).

- Load data at desired timeframe (M1, H1, D1, etc.).

- To ensure quality, use a tool like Tick Data Suite to enter tick data more accurately.

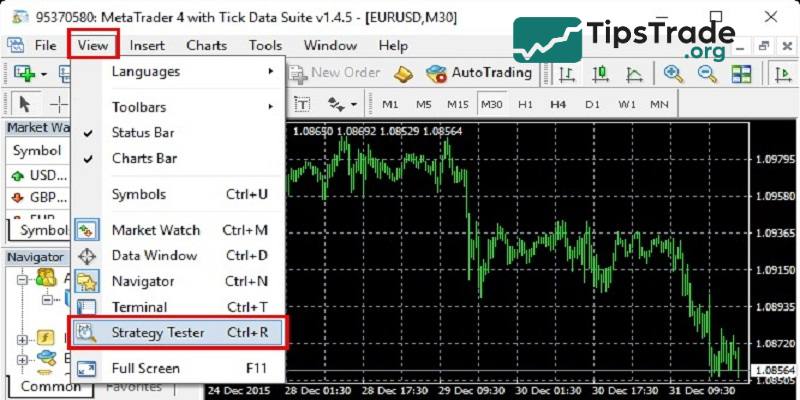

Step 2: Open Strategy Tester

– Press Ctrl+R or enter View > Strategy Tester in the MT4 trading software to open the strategy tester.

– In the Strategy Tester window:

- Select Expert Advisor you want to backtest.

- Select Symbol (currency pair/asset).

- Select Timeframe (time frame).

- Select Date Range (backtest period).

- Select Model: Every tick (most accurate, but slow); Control points or Open prices only (faster, but less accurate).

– Put Spread: Enter the broker’s actual spread (e.g. 20 for 2.0 pips).

Step 3: Configure EA

– Press the button Expert Properties to adjust:

- Inputs: Change EA parameters (e.g. lot size, stop loss, take profit).

- Initial Deposit: Set the initial capital (e.g. 10,000 USD).

- Optimization: Turn it on if you want to optimize parameters (but be careful with overfitting).

Step 4: Run backtest

- Press Start to start backtesting. MT4 will simulate trades based on historical data.

- Once completed, view the results in the tab Results, Graph, or Report.

Step 5: Analyze and optimize

- If the results are not as expected, adjust the EA parameters and run again.

- Export report (right click on tabReport > Save as Report) for detailed analysis.

Attention:

- Ensure historical data is highly accurate (at least 90% of the tim on History Center).

- Up to slippage, swap, and commissions to simulate reality.

- Test EA on a demo account before using it on a real account.

How to backtest on TradingView

Thanks to its intuitive interface and Pine Script programming language, TradingView has become a popular tool that supports both manual and automated backtesting. Here are detailed instructions on how to perform backtesting on this platform:

Manual backtest on TradingView

– Open chart:

- Go to TradingView, select the asset pair (e.g. BTC/USD) and timeframe (H1, D1, etc.).

– Time scroll:

- Use the time scroll bar or feature Replay (clock icon on the toolbar).

- Select a starting point on the chart and replay each candle.

– Apply strategy:

- Record entry and exit points according to your strategy.

- Use the ruler to calculate profit/loss.

– Record results:

- Record information like win rate, profit, drawdown in Excel or notebook.

Automated Backtest on TradingView (using Pine Script)

– Write Pine Script code:

- Open Pine Editor (at the bottom of the TradingView interface).

- Code your strategy. For example, a strategy to buy when MA50 crosses above MA200:

//@version=5

strategy("MA Crossover Strategy", overlay=true)

fastMA = ta.sma(close, 50)

slowMA = ta.sma(close, 200)

if (ta.crossover(fastMA, slowMA))

strategy.entry("Buy", strategy.long)

if (ta.crossunder(fastMA, slowMA))

strategy.close("Buy")

plot(fastMA, color=color.blue)

plot(slowMA, color=color.red)– Add strategy to chart:

- Press Add to Chart after saving the code.

- The strategy will display buy/sell points on the chart.

– View backtest results:

- Open tab Strategy Tester (below chart).

- Look at key metrics to evaluate your strategy as instructed above.

- Tab List of Trades show details of each transaction.

– Optimization:

- Using the feature Strategy Tester > Settings to change parameters (e.g. MA length).

- Rerun to find optimal parameters.

Attention:

- TradingView only uses data available on the chart, so make sure you load enough historical data.

- Pine Script does not simulate slippage or transaction fees, calculated manually if needed.

- To avoid overfitting, test the strategy on multiple timeframes and assets.

Common mistakes to avoid in forex backtest

For the forex backtest process to run smoothly and effectively, you need to avoid the following common mistakes:

- Data used for backtesting does not guarantee high accuracy: Make sure the data you use is complete and reliable. Data that is missing candles or trading volume can skew your results.

- Select the wrong time slot: Assuming you trade during the European session, it is not advisable to backtest the entire 24 hours.

- Ignore transaction costs: Slippage and Commission are real costs. Ignoring them can seriously skew backtest results, especially with high-frequency strategies.

- Regardless of psychological factors: A strategy may work in theory, but in practice it cannot withstand the psychological pressure of losing streaks. Therefore, it is necessary to do additional demo after backtesting.

Comparing forex backtest with forward test (Paper trading)

| Criteria | Forex Backtest | Paper Trading (Forward Test) |

| Data used | Historical data | Real-time data |

| Time required | Very fast | Must wait for trades to play out |

| Risk level | 0% (risk-free) | 0% (if using demo account) |

| Psychological impact | Low | High |

| Purpose | Initial strategy filter | Test execution and psychology |

Combining both helps traders gain more confidence before applying a strategy in live markets.

Conclusion

Forex backtest is not only a tool for testing trading strategies but also a key to helping traders make more informed decisions. When done correctly, it can help you optimize your trading system, minimize risk, and increase your chances of success. However, don’t forget that historical data cannot guarantee future results, so combine backtesting with other analytical factors for an effective investment strategy. Hopefully, this article has helped you understand forex backtest better and how to apply it intelligently!