Trading volume in forex, understanding how the market works can give traders a clear advantage. This indicator reflects market liquidity, price movement strength and investor sentiment, making it one of the most reliable technical indicators. Whether you are analyzing currency pairs, studying forex market trends or planning your own trading strategy, trading volume provides important insights into when and where to enter a trade.

What Is Trading Volume in Forex?

- In the context of financial markets, trading volume refers to the total quantity of assets or contracts traded during a given period.

- For example, in the stock market, it reflects the number of shares exchanged on an exchange like the NYSE.

- In forex, because there is no central exchange, trading volume instead refers to the number of times a price changes (tick volume) or the transaction data provided by brokers.

- Forex traders use volume to measure market participation and to determine whether a price movement is strong or weak.

- If a currency pair rises while volume increases, the move is considered more reliable. Conversely, if the price rises while volume falls, it may signal a lack of conviction behind the move.

- The concept of volume is critical in technical analysis because it provides context to price action.

- Price alone tells you where the market is moving, but volume helps you understand why it’s moving that way.

>>See more:

- What is Forex? The Complete Guide for Beginners

- Learn Forex – Beginner’s Guide to Start Trading Successfully

- List of Top forex brokers in 2025 – Most Trusted and Reliable

- Forex Capital Management Tips: The Key To Success For Professional Traders

Tick Volume – The Most Common Proxy

Because forex is an OTC market, there is no centralized volume data like in equities. Instead, most trading platforms provide tick volume, which measures the number of times the price ticks up or down during a period.

- Advantages:

- Widely available through all major brokers (MT4, MT5, TradingView).

- Highly correlated with actual volume in studies by the Bank for International Settlements and other institutions.

- Useful for detecting activity spikes during news releases.

- Disadvantages:

- Represents only the broker’s liquidity pool, not the entire market.

- May vary from broker to broker.

Despite these limitations, tick volume is trusted by professional traders because it strongly reflects underlying market activity.

For instance, when major economic news is released, both tick volume and real transaction volume tend to spike simultaneously, validating its reliability.

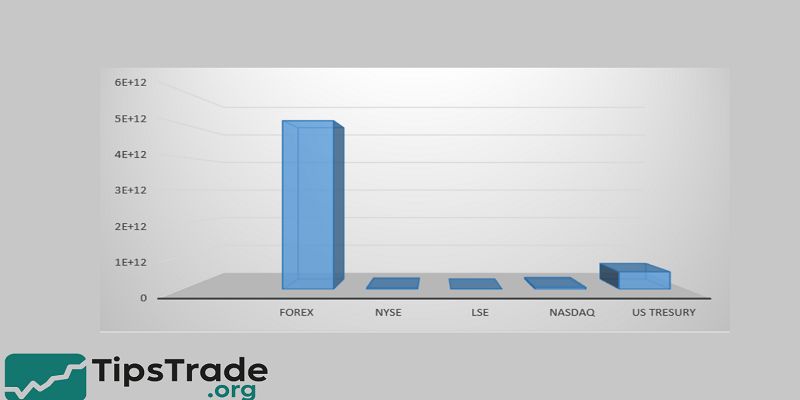

Global Scale of Forex Trading Volume

The Bank for International Settlements (BIS) Triennial Survey 2022 estimated that daily forex turnover reached $7.5 trillion, up from $6.6 trillion in 2019. This makes forex by far the largest financial market, dwarfing equities and bonds.

Breakdown of global forex turnover (2022):

- Spot transactions: $2.1 trillion

- Forwards: $1.2 trillion

- Swaps: $4.3 trillion

- Options and other products: $0.3 trillion

Geographically, the largest trading hubs are:

- United Kingdom (London) – ~38% of global turnover

- United States (New York) – ~19%

- Singapore, Hong Kong, Tokyo – combined ~15%

This data shows that most forex activity happens in a few financial centers, with the London–New York overlap being the most active time of day.

The Relationship Between Volume and Market Factors

Volume and Volatility

- Volume and volatility are closely related. Periods of high trading volume often coincide with large price swings.

- For example, when the U.S. releases non-farm payroll (NFP) data, both volume and volatility spike as traders react to the news.

- Research published by the BIS (2001) found that unexpected volume changes often precede higher volatility, indicating that traders should monitor volume carefully.

For traders, this means:

- High volume + strong volatility = potential trading opportunities.

- Low volume + high volatility = risk of slippage or thin liquidity conditions.

Understanding the interplay between these two variables allows traders to adapt their strategies based on current market conditions.

Volume, Liquidity, and Spreads

Another critical link is between volume, liquidity, and spreads. In forex, liquidity refers to how easily a currency pair can be bought or sold without moving the price significantly.

- When volume is high, liquidity improves, and spreads narrow (cheaper trading costs).

- When volume is low, liquidity is weaker, and spreads widen, increasing transaction costs.

For example, during the London–New York overlap, EUR/USD may have a spread as tight as 0.1 pips. However, during late Asian trading hours, the spread can widen to 0.5–1 pip due to lower trading volume.

This shows why understanding volume patterns throughout the day is crucial.

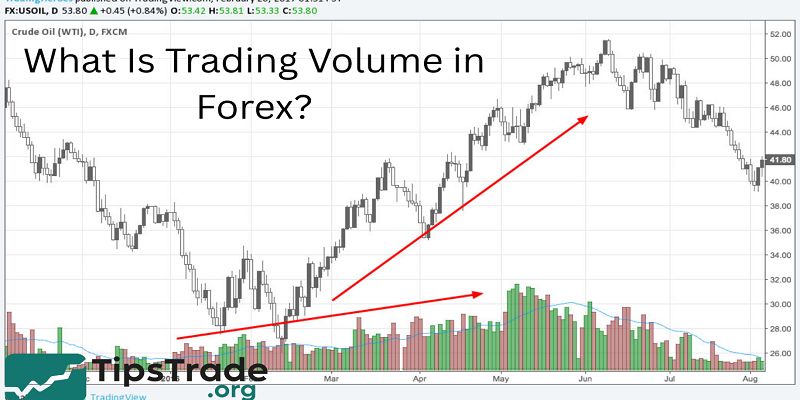

Volume and Breakouts

Volume plays a vital role in validating breakouts. A breakout refers to price moving above resistance or below support. However, not all breakouts are genuine—some are false signals triggered by low liquidity.

- Strong breakout: Confirmed when accompanied by high trading volume.

- False breakout: When price moves beyond a level but volume is weak.

For instance, if EUR/USD breaks a key resistance at 1.1000 during the London session with volume spiking, it suggests institutional traders are driving the move. But if the same breakout occurs during the quiet Asian session with low volume, it may be less reliable.

Applying Volume in Trading Strategies

Popular Volume Indicators

Several technical indicators incorporate volume data to help traders make informed decisions:

- On-Balance Volume (OBV): Measures cumulative buying and selling pressure by adding volume on up days and subtracting it on down days.

- Volume Weighted Average Price (VWAP): Shows the average price weighted by volume, often used to identify fair value levels.

- Chaikin Money Flow (CMF): Combines price and volume to show buying and selling pressure.

- Accumulation/Distribution Line: Helps identify whether a currency is being accumulated or distributed.

These indicators add depth to price charts, allowing traders to confirm trends or detect divergences.

Trading Strategies Based on Volume

Practical ways to integrate volume into trading include:

- Breakout confirmation – Enter only when price breaks support/resistance with strong volume.

- Pullback trading – Wait for a retracement with declining volume, then enter when volume picks up again.

- Avoiding low-volume periods – Many traders skip trading during late Asian hours or holidays when volume is low.

- Combining with oscillators – Volume plus RSI or MACD can filter false signals.

For example, a trader might see GBP/USD consolidating before a Bank of England announcement. A breakout accompanied by a surge in volume could provide a strong entry signal.

Limitations and Risks of Using Volume

While volume is a powerful tool, it has limitations in forex:

- No centralized data – Tick volume is only an estimate.

- Broker variations – Different brokers may show slightly different volumes.

- False signals – Algorithmic trading can create short-term volume spikes not tied to fundamentals.

Therefore, volume should never be used in isolation. It works best when combined with other analysis methods such as candlestick patterns, moving averages, and macroeconomic news.

Factors Influencing Daily Forex Volume

Trading Sessions and Overlaps

Forex volume fluctuates depending on the time of day. The four major trading sessions are:

- Sydney

- Tokyo

- London

- New York

The busiest times occur when sessions overlap:

- London–New York (13:00–17:00 GMT) → highest liquidity and volume.

- Tokyo–London (07:00–09:00 GMT) → moderate activity.

During overlaps, spreads are tighter and execution is faster, making these periods ideal for active traders.

News Events and Economic Data

- Macroeconomic releases such as U.S. non-farm payrolls, Federal Reserve interest rate decisions, or European Central Bank press conferences often trigger huge volume spikes.

- For example, the release of U.S. CPI data can cause EUR/USD to jump 50–100 pips within minutes, with volume surging as traders react.

Traders often avoid entering positions just before such announcements unless they have a specific news-trading strategy.

Seasonality and Long-Term Trends

- Forex volume also shows seasonal patterns. During major holidays (Christmas, New Year, Golden Week in Japan), volume tends to drop significantly.

- The summer months also see reduced activity as institutional traders take vacations.

- Long-term trends are also shifting. According to the New York Fed, the share of FX swaps has grown over the past decade, reflecting the market’s increasing complexity.

- This structural shift impacts overall volume distribution across products.

Comparing Forex Volume With Other Markets

Forex vs. Equities

- The key difference between forex and equities lies in transparency. Stock exchanges provide exact volume data for each security.

- Traders can see precisely how many shares traded in a session.

- In forex, because it’s OTC, traders rely on tick volume estimates. However, forex liquidity far exceeds that of equities.

- For example, Apple’s average daily stock trading volume is around $10–15 billion, whereas daily forex turnover is $7.5 trillion.

- This highlights forex’s unmatched liquidity.

Forex vs. Futures

- Currency futures (traded on exchanges like the CME) do provide exact volume data. However, the total futures market is much smaller than OTC forex.

- Daily currency futures volume is roughly $100–200 billion, a fraction of the spot and swap market.

- Still, many traders use futures volume as a proxy for institutional activity, since futures are exchange-traded and transparent.

- Combining OTC tick volume with futures data can give a fuller picture.

>>See more:

- What are exchange rates? How to read and analyze rates in Forex

- The Impact of Central Bank vs Forex – Understand to Invest Effectively

- Interest rate forex impact: How it affects currency value

Conclusion

Forex trading volume is one of the most important tools in a trader’s arsenal. While the decentralized nature of forex means that “true” volume is not available, tick volume has proven to be a reliable proxy. Volume provides valuable insights into market participation, liquidity, and the strength of price movements.The article above from Tipstrade.org has just provided you . We hope that you find it useful. Wishing you successful trading!