When you first join the forex market, choosing the right top forex brokers will help you avoid risks and trade more smoothly. So, which forex platform is the best today? Below, Tipstrade.org has compiled a list of top forex brokers for you to refer to. Let’s get started!

What is a forex broker?

Forex Broker is an intermediary company or organization that provides a trading platform for investors to buy and sell currency pairs in the foreign exchange market. Specifically:

- They connect individual traders with the global foreign exchange market.

- Forex brokers usually provide trading software (such as MT4, MT5, cTrader…) for customers to place buy/sell orders.

- They make profit mainly from spread (difference between buy and sell prices) or transaction commissions.

- In addition, brokers also provide leverage, allowing traders to trade larger volumes than their actual capital.

For example: If you want to trade the EUR/USD pair, you cannot directly access the interbank market but must go through a Forex broker to execute the order.

>>See more:

- What is Forex? The Complete Guide for Beginners

- Forex strategy: Top 10 most effective strategies for beginners

- Important Economic Indexes Every Trader Needs To Know

- Top 10 best forex currency pairs to trade in 2025

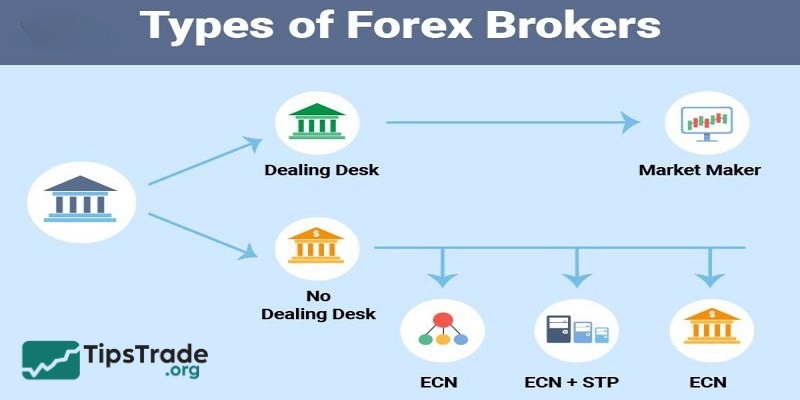

Different types of forex brokers

When you enter the Forex market, you will come across brokers operating in many different models. Here are some of the common types:

Market Maker

A broker that directly executes your orders. This means that when you buy, the broker sells and vice versa. Market Makers usually have an intuitive, easy-to-use trading interface. However, there can be a conflict of interest because the broker’s profits come from your losses.

Straight Through Processing (STP)

A model where your trading orders are sent directly to major liquidity providers in the market, without broker intervention. It is characterized by low latency, fast execution and generally lower transaction costs. However, prices may slip in volatile market conditions.

Direct Market Access (DMA)

It works similarly to STP, but DMA allows investors to send orders directly to the market. With high transparency, investors have full control over their trading orders. Note that this form requires investors to have certain knowledge and experience in the market.

Electronic Communication Network (ECN)

This is a form of using an electronic system to connect investors together, automatically matching buy and sell orders. The advantages are high transparency, low transaction costs and good liquidity. However, this model may require a larger initial deposit.

Why care about the top forex brokers?

Choosing the right reputable Top Forex Brokers is extremely important for traders. Because it will help you access the Forex market more effectively, while minimizing risks such as hidden fees, slippage as well as security issues when trading. Usually, Top Forex Brokers have the following common characteristics:

- Regulated by reputable financial institutions.

- Provide a stable and friendly trading platform.

- Has a transparent and competitive fee policy.

- Support for a wide range of assets and analytical tools.

- …

However, no reputable Top Forex Brokers will be suitable for all levels of traders. Because each trader will have different needs in terms of fees, functions, customer care policies or types of trading products,…

>>See more:

- Copy Trade Forex: Key Tips to Maximize Your Profits

- News Trading Forex Strategies for Beginners

- Forex Capital Management Tips: The Key To Success For Professional Traders

List of top forex brokers in 2025

If you are wondering which Top Forex Brokers to choose to ensure prestige when trading, you can refer to the names below:

LiteFinance

LiteFinance (formerly known as LiteForex) is a forex and CFD broker, founded in 2005. The platform offers a wide range of trading assets globally, along with powerful analytical tools and professional customer support. Over the years of operation, LiteFinance is now one of the forex brokers chosen and highly appreciated by many traders.

Below is some basic information about LiteFinance – the most reputable forex brokers today:

- License: CySEC and FSC

- Platforms: MT4, MT5, cTrader and mobile apps

- Account types: Demo, ECN, CLASSIC and CENT

- Minimum deposit: From $10

- Customer support: 24/5

Website: https://litefinance.vn/

Some of the outstanding advantages and disadvantages of LiteFinance are as follows:

Advantage:

- Competitive spread fees

- Various deposit and withdrawal methods

- Prestigious operating license

- Customer insurance program up to 5 million Euros

- Separation of trader deposits from company funds

- Popular trading platforms (MT4, MT5)

- Support multiple trading accounts

- Offers a wide variety of trading products

Disadvantages:

- Spreads are highly elastic when the market is volatile.

XM

XM is the second name on the list of top forex brokers in 2025. With many years of experience in the Forex market, XM has solidified its position and earned the trust of a large number of individual and institutional investors worldwide.

XM is also licensed by prestigious financial organizations such as FSC, ASIC, CySEC, DFSA, and others. The broker leads the market with over 5 million clients from 190 countries, executing billions of trades without requotes or rejected orders. In particular, XM has 600 experienced financial professionals ready to support traders.

Some of XM’s outstanding advantages include:

- Holding licenses from many reputable global financial entities.

- A diverse investment portfolio with a wide range of financial products.

- Fast order execution with no requotes.

- Low spreads and competitive commissions.

Exness

Exness is a broker founded in 2008 by a group of IT and financial experts and is regulated by the world’s leading organizations, including FSA, FSC, FSCA, CBCS, CySEC and FCA.

Exness has achieved many prestigious achievements since its inception, including the following awards: Most Transparent Forex Broker 2019, Global Forex Broker of the Year 2019 in Europe. Some outstanding features of Exness:

- Diversified portfolio with stable leverage

- Support many types of accounts to suit every customer

- Fast payment 24/7 with many different methods.

- Popular trading platforms MT4 and MT5

- Low transaction fees with extremely fast order matching speed,…

IC Markets

IC Markets is one of Australia’s oldest and most reliable forex trading platforms. Currently, IC Markets has more than 180,000 clients from various countries, with a trading volume of USD 1.11 trillion.

Some key advantages of IC Markets include:

- Regulated by reputable financial authorities such as FSA, CySEC, ASIC, and SCB

- Wide range of financial instruments including Forex, commodities, metals, stocks, etc.

- Offers three powerful trading platforms: MT4, MT5, and cTrader

- Ultra-fast order execution speed

- Competitive spreads starting from 0.0 pips

- Fast deposits and withdrawals with multiple payment methods

However, the minimum deposit requirement is relatively high, starting from 200 USD, and the maximum leverage offered is 1:500 – a ratio that is less attractive compared to other Forex brokers in the market.

XTB

XTB entered the market in 2002 as the first leveraged Forex and CFD broker in Poland. It also became one of the few Forex brokers to be listed on the Warsaw Stock Exchange in 2016.

Throughout its operations, XTB has served over 495,000 clients worldwide with 550 global employees and executes 168,000 trades daily. Some of XTB’s key highlights include:

- Offering over 2,100 trading products, from Forex to indices, commodities, stocks, and cryptocurrencies.

- Providing the exclusive xStation trading platform, which allows traders to manage their trades easily.

- Competitive spreads and commissions.

- Extremely fast order execution speed.

- Quick deposits and withdrawals via Visa/Mastercard, e-wallets, and Ngan Luong (a Vietnamese payment gateway).

- Frequently offering promotional programs for clients.

However, since XTB currently only supports one type of trading account and does not offer the popular MT4/MT5 trading platforms, it is not highly rated by some traders.

FBS

Founded in Belize in 2009, FBS is a long-standing Forex broker known for its many client benefits, in addition to a cashback policy for losing trades. The broker also offers a variety of attractive promotions for new clients.

Advantages:

- The broker is licensed and supervised by reputable financial entities such as CySEC, IFSC, FCA, and FSC.

- It supports multiple account types—Cent, Zero Spread, Micro, and Standard—to suit the needs and finances of each investor.

- It offers a variety of payment methods for clients.

- It provides access to MT4 and MT5 with numerous analytical tools and technical indicators.

- It offers many educational resources and instructional videos for beginners.

- It provides 24/7 customer service via email, phone, and live chat.

Disadvantages:

- FBS’s website interface is not well-optimized, which can be difficult for newcomers to navigate.

- FBS’s customer service can sometimes be slow to respond.

IG

IG is also considered a top name among the top forex brokers thanks to its long history, powerful trading platform and diverse product portfolio, IG offers over 80 currency pairs, a user-friendly platform, high-quality educational materials and strict regulations in the UK, Australia, Singapore and many other countries.

Advantage:

- Present in 19 countries.

- Listed on the London Stock Exchange.

- No minimum deposit required.

Disadvantages:

- Social trading is not supported.

- Some Forex pairs are restricted.

Tickmill

Tickmill is a well-known ECN broker with low commissions and highly competitive spreads. This makes it an ideal choice for professional and long-term traders. In 2025, Tickmill introduced free VPS for accounts from $500, which is very useful for traders who use EAs (trading robots).

Advantages:

- Low spreads, with commissions starting from just $2/lot.

- No restrictions on trading strategies.

- Licensed by the FCA and CySEC.

- The Pro account is suitable for professional traders.

Disadvantages:

- No bonus programs.

- The trading platform only supports MT4.

FXTM

FXTM is a well-known broker famous for its diverse account customization options, from Cent to ECN. It’s one of the most highly-rated brokers in Asia and Africa.

Advantages:

- Cent and Micro accounts are available for beginners.

- Flexible leverage up to 1:2000.

- Licensed by the FCA and CySEC.

- Full support for the MT4 and MT5 platforms.

Disadvantages:

- The spreads on the Standard account are not very competitive.

- Withdrawal speeds can sometimes be slow during peak hours.

HFM

HotForex, now known as HFM, rebranded in 2022 but has maintained its reputation for over 10 years of operation, serving millions of clients globally. This broker is particularly well-known for its excellent support services and stable trading platforms. In 2025, HFM expanded its product portfolio, adding many new indices and commodities.

Advantages:

- Leverage is available up to 1:1000.

- Offers multiple account types suitable for all levels of traders.

- Licensed by the FCA, CySEC, and FSCA.

- Deposits and withdrawals are fee-free and support Vietnamese banks.

Disadvantages:

- ECN account commissions are slightly high compared to competitors.

- Not very strong on bonus programs.

Criteria for evaluating top forex brokers

A question arises: “How can we know whether the Top Forex Brokers are reliable or not?” Accordingly, the leading Top Forex Brokers are usually evaluated and compared based on the following criteria:

Licenses and regulations

The first and decisive factor when choosing a reputable Top Forex Brokers is having operating license from leading financial regulators. Being licensed and regulated by reputable organizations shows that the exchange strictly complies with regulations on capital, security and legal obligations to customers. Below is a list of the most reputable financial regulators in the world today:

- ASIC (Australian Securities and Investments Commission): Ensuring transparency and investor protection in Australia.

- FCA (Financial Conduct Authority): The UK’s prestigious financial regulator, renowned for its strict regulations.

- CySEC (Cyprus Securities and Exchange Commission): Popular in the European region, suitable for platforms serving international traders.

- NFA (National Futures Association): Regulates forex brokers in the US with high standards of financial security.

Visit the official website of the Forex broker and check the information about the broker’s license. If you cannot find any legal information about the broker in many ways, it may be a warning sign for you about a fraudulent Forex broker.

Transparent and competitive fees

One of the key factors that affects a trader’s long-term profitability is spending transaction fees. Top professional and reputable Forex Brokers need to publicize and optimize the following types of costs:

- Spread: This is the difference between the buy and sell price. It usually ranges from 0.1 to 1 pip for major currency pairs (EUR/USD, USD/JPY). The lower the spread, the lower the trading cost for traders.

- Commission: Applied per lot traded, commonly used with ECN accounts.

- Overnight Fee (Swap): Overnight holding costs, which should be considered if you are trading long term.

You should prioritize choosing Top Forex Brokers with competitive spread fees, and especially without hidden fees. For example, some brokers like IC Markets or Exness stand out with spreads from 0.0 pip on Raw Spread accounts, suitable for experienced traders. Therefore, users need to read the terms carefully before opening an account at the broker to avoid unwanted risks.

Optimal and stable trading platform

To execute successful Forex trading strategies, trading platforms are an indispensable core tool. Accordingly, a reputable Top Forex Brokers must provide customers with modern trading software, fast processing speed, and must integrate in-depth analysis tools. Some popular Forex trading platforms on the market today include:

- MetaTrader 4 (MT4): Popular with its user-friendly interface and support for a wide range of technical indicators.

- MetaTrader 5 (MT5): Upgrade with multi-asset trading capabilities and advanced risk management tools.

- cTrader: Popular for its superior order matching speed, ideal for scalping.

Another equally important factor is the stability of the trading system of the exchange, especially during extremely sensitive market times such as economic news releases. You should also consider whether the exchange supports mobile applications and copy trade functions, as these are useful utilities for both newbie and professional traders.

Flexible and fast deposits/withdrawals

The next measure of a Forex broker’s reliability is about ability deposit – withdrawal effective or not. The criteria to be evaluated include:

- Various payment methods: Supports domestic bank transfers, e-wallets (Skrill, Neteller) and credit/debit cards.

- Processing speed: Withdrawal within 1-2 hours is reasonable.

- Deposit/Withdrawal Policy: Free deposit/withdrawal is the best.

Advice: First, you should trade with a small amount of capital and try to withdraw money to verify the deposit and withdrawal process of the exchange, then consider depositing a larger amount.

Professional customer support service

The Forex market operates 24/5, as you likely already know if you’ve been doing your research. Because of this, top Forex brokers need to have a customer support team that can answer client questions instantly.

Here are the essential standards:

- Multi-language support: Having Vietnamese available is a huge advantage for local traders.

- Flexible communication channels: Live chat, email, and hotlines should have a response time of under 5 minutes.

- Professional support team: The broker’s staff should be able to solve problems quickly and effectively.

A practical tip: Before you sign up, try contacting the customer support team of the broker you are considering. This will help you evaluate their service quality. A reliable top Forex broker will not leave their clients “lost” when they encounter an issue.

Leverage policy and risk management

Leverage is a powerful financial tool that helps traders amplify profits, but it also carries certain risks. A good Top Forex Broker should provide:

- Flexible leverage: From 1:50 – 1:2000, depending on your needs and experience.

- Protection tools: Negative balance protection policy helps traders avoid falling into debt when the market fluctuates unexpectedly.

For new traders, it is advisable to start with low leverage, for example 1:50 or 1:100, to get familiar with the market. On the contrary, experienced traders can choose higher leverage, but need to ensure that you have built a strict money management system.

Community and expert reviews

When evaluating any Top Forex Brokers, consulting the community can provide valuable information. Find out:

- Trader Forum: ForexFactory, BabyPips or Telegram/Facebook groups in Vietnam.

- Independent review website: Forex Peace Army, Trustpilot provides unbiased reviews from real users.

However, you should be very careful when reading unusual comments of praise or criticism. Because sometimes it is just a PR trick or smear from competitors. It is best to focus on constructive comments, balancing the pros and cons.

Educational resources and tools

In addition to providing users with trading services, reputable and professional Top Forex Brokers also focus on investing in education for traders. Notable factors include:

- Demo account: Risk-free practice environment to test strategies.

- Study materials: Webinars, online courses, daily market analysis.

- Analysis tools: Economic calendar, trading signals, advanced indicators.

Conclusion

Above is a list of the top forex brokers in 2025, chosen by many investors worldwide. Hopefully, this information will provide you with a solid foundation to make smart decisions when participating in Forex trading. Take your time to consider carefully, compare the criteria, and choose a suitable broker to start your effective investment journey. Wishing you success!