What is Prop Firm? This is one of the questions that many new traders entering the financial market often ask. A prop firm, or Proprietary Trading Firm, is a model that allows traders to trade using the company’s capital instead of their own money. This article will help you understand the concept, how it operates, and the notable benefits of participating in a prop firm, thereby helping you assess whether this is a suitable option to enhance your chances of success in trading.

What is prop firm?

Prop firms, also known as proprietary trading firms, are financial organizations or businesses that engage in trading financial instruments such as stocks, bonds, commodities, or currencies using their own capital, rather than using clients’ money. The main goal of a Prop Firm is to generate profits through well-structured trading strategies. Unlike traditional brokerage firms, Prop Firms do not manage client accounts or provide investment services to the public.

>>See more:

- Prop Firm vs Broker: Which Option Fits Your Trading Style Best?

- Prop Firm trend: How It Shapes Modern Trading

- Instant Funding: How It Enhances Trading Efficiency

How prop firms operate

What is prop firm? Prop Firms operate on a trading funding model for traders, allowing them to use the company’s capital instead of their own money. However, to get funded, traders need to go through a number of assessment steps and comply with the company’s regulations. Here is the basic operating process of a Prop Firm:

Register and take the test

Before receiving capital, traders must take an aptitude test. This test usually requires:

- Achieve a certain level of profit within a specified time.

- Adhere to risk management rules, such as daily loss limits or maximum total loss.

Receiving a funded account

If the trader passes the test, they will be given a trading account with much more capital than they initially have. This account can range from a few thousand to hundreds of thousands of dollars, depending on the policy of each Prop Firm.

Profit sharing

Traders trade as usual, but instead of taking the risk themselves, they receive a percentage of the profits, usually 70% – 90%, with the rest going to the Prop Firm. This allows traders to make money without investing their own capital.

Compliance with rules and conditions

Each Prop Firm will have its own regulations regarding risk management, such as:

- Do not exceed the maximum allowable loss.

- Trade only during specific hours.

- Must maintain a certain win rate to continue receiving capital.

- If a trader violates these rules, they may have their account revoked or be required to retake the test.

Withdraw profits and grow your account

Once a trader has made a profit, they can withdraw their funds according to the Prop Firm’s payout schedule. Some firms also have account upgrade programs, allowing traders to trade with increasingly larger amounts of capital if they maintain good performance.

Benefits of trading with a prop firm

What is prop firm? Trading with a prop firm offers many attractive benefits, especially for skilled traders who lack sufficient capital. Below are the key advantages of joining this model:

- No personal investment required: Instead of investing large sums of money to trade, traders can use capital from Prop Firm. This helps them minimize financial risks and avoid losing money out of pocket if they experience losses.

- Access to large capital: Prop Firms can offer trading accounts from $10,000 to $500,000 or more. This allows traders to trade larger volumes, maximizing profits without being limited by personal capital.

- Limit risks when trading: Traders are not liable for large losses as they would be if they were using personal funds. If they follow the trading rules, they can continue to receive capital without worrying about losing too much.

- Opportunity to scale up accounts: Some prop firms have a scaling program that allows traders to increase their trading capital. If they maintain good performance, they can be upgraded to an account with more capital, thereby increasing their profits over time.

Step by step guide to getting started with prop firm

What is prop firm? If you want to trade with Prop Firm, here are the important steps to get started effectively and increase your chances of getting funded:

Step 1: Choose the right prop firm

Each prop firm has different conditions and policies. You should consider the following factors to choose the right platform such as:

- Funding Level ($10,000 – $600,000)

- Profit sharing ratio (70% – 90%)

- Evaluation process (1 step or 2 steps)

- Participation fee (usually from 50 USD and up)

- Supported asset types (Forex, Futures…)

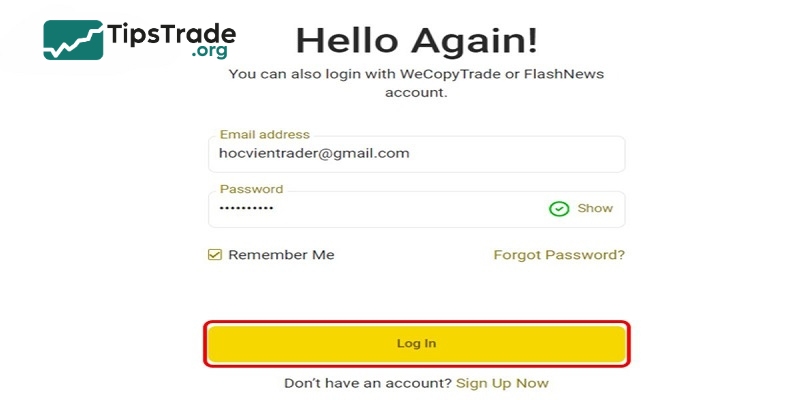

Step 2: Register an account & select an evaluation package

After choosing Prop Firm, the next step the user needs to do is:

- Sign up for an account on their website

- Choose a challenge account package (usually ranges from $10,000 – $100,000)

- Finally pay the entry fee

Step 3: Complete the evaluation challenge

Prop Firms often require traders to achieve profit targets within a certain time frame without violating risk management rules.

- Phase 1: Generate 8% – 10% profit without excessive loss

- Phase 2: Maintain stable performance and do not let the account decrease beyond the specified threshold

Note: If you fail the challenge, you can try again but will need to pay the registration fee again

Step 4: Receive a live trading account

Upon completion of the challenge, you will be given a real trading account with the registered capital. At this point, you can start trading and enjoy the profit sharing ratio according to Prop Firm’s policy.

Step 5: Trade & withdraw profits

Once you have a real account, focus on an effective trading strategy and follow the rules to avoid losing your account. If you make a profit, you can withdraw your money according to Prop Firm’s payment schedule (usually 14 days or monthly).

Conclusion

Through the above analyses, you surely have the answer to the question “What is Prop Firm?” as well as a clear understanding of how this model operates and the benefits it brings to traders. Joining a prop firm can be a strategic move to leverage significant capital, reduce personal risk, and maximize your profit potential. If you are looking for an opportunity to advance your trading career, a prop firm is a choice worth considering.