Mutual funds are a popular investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities managed by professional fund managers. Mutual funds offer individuals access to a broad range of assets and expert management, making investing more accessible and less risky. Through this article, let’s explore the details more deeply together at tipstrade.org.

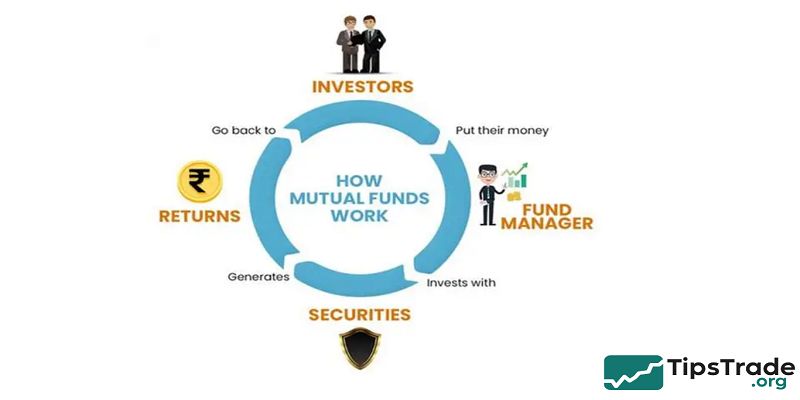

How Mutual Funds Work

A mutual fund operates through three main entities: fund manager, custodian, and investors.

- Fund Manager: makes investment decisions on behalf of shareholders.

- Custodian: a regulated bank or institution that safeguards assets.

- Investors: provide the capital and receive “units” proportional to their contribution.

The key principle is pooling money for diversification. Instead of buying one or two stocks, investors gain exposure to a large portfolio. This reduces concentration risk: if one company performs poorly, others in the fund may offset the loss.

A central metric is Net Asset Value (NAV):

NAV=Total Assets – LiabilitiesUnits OutstandingNAV = \frac{\text{Total Assets – Liabilities}}{\text{Units Outstanding}}NAV=Units OutstandingTotal Assets – Liabilities

NAV represents the price per unit and is calculated once at the end of each trading day. When investors buy or redeem units, the transaction is executed at that day’s NAV.

Earnings come in two forms:

- Dividends: from interest payments or stock dividends.

- Capital gains: when securities are sold at a profit.

According to Fidelity Investments, mutual funds are especially appealing to long-term investors who prioritize simplicity and diversification over active daily trading.

Types of Mutual Funds

Mutual funds come in many forms, each tailored to different investment goals and risk appetites.

Equity Funds (Stock Funds)

- Equity funds primarily invest in company shares. They can focus on large-cap, mid-cap, or small-cap stocks, or on growth versus value strategies.

- Because they are linked directly to stock market performance, equity funds carry higher risk but also offer the highest potential returns over the long term.

- For example, Morningstar data shows that U.S. large-cap equity funds averaged annualized returns of 8–10% over the last decade, albeit with significant volatility.

- Equity funds suit investors with long-term horizons and a willingness to withstand market ups and downs.

Debt Funds (Bond Funds)

- Debt funds invest in fixed-income securities such as government bonds, corporate bonds, and debentures.

- Their main purpose is to provide stable income with lower volatility than stocks.

- These funds are attractive to conservative investors, retirees, or those looking for predictable cash flows. However, risks include interest rate fluctuations and credit defaults.

- While safer than equities, bond funds may underperform during inflationary periods when bond yields rise.

Balanced or Hybrid Funds

- Balanced funds combine equities and bonds within a single portfolio. The goal is to balance risk and return.

- For instance, a typical hybrid fund might allocate 60% to equities for growth and 40% to bonds for stability.

- Such funds are well-suited for medium-risk investors who want exposure to both asset classes without actively rebalancing.

- They often perform better in volatile markets, cushioning losses when equities decline.

Money Market Funds

- Money market funds invest in short-term, low-risk instruments like Treasury bills, commercial papers, and certificates of deposit.

- According to Investopedia, they are considered one of the safest types of mutual funds.

- While returns are modest (often 2–4% annually), these funds provide excellent liquidity and capital preservation.

- Investors often use them as a “parking place” for cash or emergency funds.

Index Funds and ETFs

- Index funds track a specific market index, such as the S&P 500 or VN-Index.

- Because they replicate rather than actively manage portfolios, they come with lower expense ratios.

- ETFs (Exchange-Traded Funds) are similar but trade on stock exchanges like regular shares. This gives investors intraday liquidity.

- Both products are cost-efficient and transparent, making them ideal for passive, long-term investors.

Specialty Funds (Sector, International, ESG)

- Specialty funds focus on niche areas such as technology, healthcare, or renewable energy.

- International funds provide exposure to foreign markets, while ESG funds (Environmental, Social, Governance) prioritize sustainability.

- According to Morningstar’s 2024 Sustainable Funds Report, ESG funds saw record inflows due to growing demand for ethical investing.

- While specialty funds can deliver high returns during favorable market cycles, they are also riskier due to concentration in specific industries.

Advantages of Mutual Funds

Mutual funds offer numerous benefits, especially for beginners.

- Diversification: Investors gain exposure to a wide range of securities, reducing risk.

- Professional Management: Portfolio managers use expertise, research, and tools to make informed decisions.

- Liquidity: Open-ended mutual funds allow investors to buy or sell daily at NAV.

- Accessibility: Many funds require low minimum investments, making them beginner-friendly.

- Regulation: Funds are overseen by financial authorities such as the SEC or national regulators, ensuring transparency.

- Transparency: Investors can access daily NAV updates and periodic reports on holdings and performance.

For small investors, these features provide a cost-effective way to participate in capital markets without needing extensive knowledge or large amounts of capital.

Limitations and Risks of Mutual Funds

Despite their popularity, mutual funds are not risk-free.

- Costs: Expense ratios, sales loads, and hidden fees can erode returns.

- Lack of Control: Investors cannot choose individual securities within the fund.

- Market Risk: Mutual fund values fluctuate with broader market conditions.

- Performance Risk: Even actively managed funds may underperform benchmarks.

- Tax Liabilities: Dividends and capital gains distributions are taxable events in most jurisdictions.

As the Financial Industry Regulatory Authority (FINRA) highlights, investors must always read a fund’s prospectus to understand fees, risks, and historical performance.

Mutual Funds vs. ETFs vs. Hedge Funds

- Mutual Funds: Priced once daily at NAV, suitable for long-term investors who prefer systematic investment.

- ETFs: Trade like stocks during market hours, usually with lower expense ratios and greater flexibility.

- Hedge Funds: Accessible mainly to high-net-worth individuals, hedge funds use complex strategies (short selling, leverage, derivatives) and are less regulated.

When to choose:

- Mutual Funds: For beginner investors seeking simplicity and professional management.

- ETFs: For cost-conscious investors who want intraday trading flexibility.

- Hedge Funds: For wealthy investors seeking high-risk, high-return opportunities.

How to Choose the Right Mutual Fund

Choosing the right mutual fund requires a systematic approach:

Define Financial Goals

- Short-term (1–3 years): capital preservation, income generation.

- Medium-term (3–7 years): balance of growth and stability.

- Long-term (>7 years): aggressive growth through equity exposure.

Assess Risk Tolerance

- Tools like risk profiling questionnaires can help investors evaluate whether they are conservative, moderate, or aggressive.

Compare Expense Ratios and Fees

- Even a 1% difference in annual fees can significantly reduce returns over 20 years.

- Passive index funds often charge less than 0.2%, while active funds may charge 1–2%.Analyze Performance History

Look at 3-year, 5-year, and 10-year returns, and compare them against the fund’s benchmark index.

Evaluate Fund Manager and AMC

- A strong track record and reputable Asset Management Company are key indicators of reliability.

Steps to Invest in Mutual Funds

- Open an Account: With an Asset Management Company (AMC), bank, or broker. Complete Know Your Customer (KYC) requirements.

- Select a Fund: Based on goals, risk profile, and research.

- Choose Investment Method:

- SIP (Systematic Investment Plan): invest fixed amounts periodically.

- Lump Sum: invest a large amount at once.

- Monitor Performance: Compare with benchmarks and adjust if necessary.

- Redeem Units: Withdraw funds when goals are met, or reallocate if performance is unsatisfactory.

Mutual Fund Trends in 2025

- Growth of ESG Funds: Ethical and sustainable investing continues to rise.

- AI in Portfolio Management: Artificial intelligence assists in risk analysis and stock selection.

- Digital Platforms & Robo-Advisors: Simplify access for retail investors.

- Asia’s Emerging Markets: Countries like Vietnam, India, and China are seeing rapid growth in mutual fund participation.

- Lower Costs: Competition is driving down management fees, favoring passive strategies like index funds.

Conclusion

Mutual funds provide investors with a convenient and effective way to build a diversified portfolio while benefiting from professional management. Mutual funds help reduce risk by spreading investments across different asset classes and securities, making them suitable for both beginners and experienced investors.